The easiest and fastest way to file your TDS Return Onlines

- LegalRaasta is a registered e-filing intermediary of the Income

Tax Department with 40,000+ users

Apply Now!

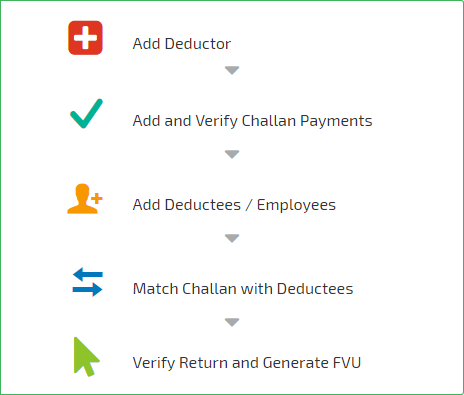

Process to file TDS

Would You Like Assistance from an Expert?

Buy CA assisted plan & Get Tax saving tips from professionals

Free Demo

Free

- ✔ First 4 Returns Free

- ✔ FVU Generation

- ✔ Challan Verification

- ✔ PAN Verification

Software (Standard Edition)

₹ 4,999

- ✔ For 1 Year

- ✔ Unlimited Return

- ✔ FVU Generation

- ✔ Challan/PAN Verification

Assisted Filing (Single)

₹ 799

- ✔ For 1 Return

- ✔ Files Your Return

- ✔ FVU Submission With NSD

- ✔ Challan Verification

Assisted Filing (Package)

₹ 2,499

- ✔ 4 Returns

- ✔ CA Files Your Return

- ✔ FVU Submission With NSDL

- ✔ Challan Verification

Our software supports TDS on Salary payments (Form 24Q), Rent, Interest, Commission, and other Non-salary transactions (Form 26Q), NRI (Form 27Q), and TCS (Form 27EQ).

Features

How we are different?

Import data from Excel and TDS files

Automatically verify TAN and PAN number

Import data from Excel and TDS files

Automatically Calculate TDS

Submit the return in FVU format without any difficulty

Generate Form 16, 16A, and more with ease

What is TDS ?

TDS (Tax Deducted at Source) is an associate indirect system of deduction of tax in line with the

taxation Act, 1961 at the purpose of generation of Income. Tax is deducted by the payer and is

dispatched to the government by him on behalf of the recipient.

A TDS Return could be a quarterly statement that must be submitted to the taxation department of

India. Submitting TDS Return is necessary if you’re a

deductor. It has details of TDS deducted and

stored by you.