UAN Member Portal: UAN Login, UAN Online Services

UAN: What is it?

UAN member portal helps an individual with EPF to connect all his Provident Fund accounts across all the organizations they were employed under. The Employee's Provident Fund and Miscellaneous Act of 1952 introduced a saving scheme for salaried employees of companies known as the Employee Provident Fund (EPF). Under this scheme, employees contribute 12% of their basic salary as well as a dearness allowance on which they earn a fixed amount of interest set by the EPFO. In accordance with this, every person who is availing this savings scheme is allocated a 12-digit UAN (Universal Account Number). This UAN helps the employee access the various PF accounts on the UAN member portal. Let's look at how you can access the basic services such as creating an account, logging in, resetting the password on the UAN Login portal with the help EPF member e-Sewa.

Whenever you join a new job where the Provision of Provident Fund is applicable, the Employee Provident Fund Organization (EPFO) allocates member Identification Digits (ID) which is linked to the UAN. Each member ID is assigned to the UAN for a particular organization and will change with respect to a particular company. The UAN is a Permanent Account Number and it is portable as well as remains the same throughout the lifetime of an employee.

On this portal, a UAN member can access the details related to their employee KYC, Service record, UAN card (which has been allocated by the EPFO).

Important Points Related to UAN

- UAN is a unique number which is allocated to employees irrespective of their current/previous employers

- Employers can authenticate and certify the identity of employees through UAN (if KYC is verified)

- UAN helps in providing online services. Hence there is no chance of holding back the PF or deducting it by the employers

- Employees can keep a track of the PF deposited to their accounts every month by registering themselves on the EPF/UAN member portal

- Access the EPF passbook via text message SMS EPFOHO UAN ENG for English to 7738299899 via the mobile number registered with the EPFO or EPFOHO UAN HIN for Hindi. You can also type in the first three letters of your preferred language.

How to check your UAN Number

Through Employer

When you create and avail the benefits of the EPF savings scheme via the employer, the employer will have knowledge of your UAN number as they have to create the same for every employee. When you create and avail the benefits of the EPF savings scheme via the employer, the employer will have knowledge of your UAN number as they have to create the same for every employee of the company. Head over to the accounts department of your company and ask them for your UAN number. They should be able to furnish the relevant information to you.

Some employers also print the UAN number of concerned employees in the Salary Slip.Through UAN Member Portal

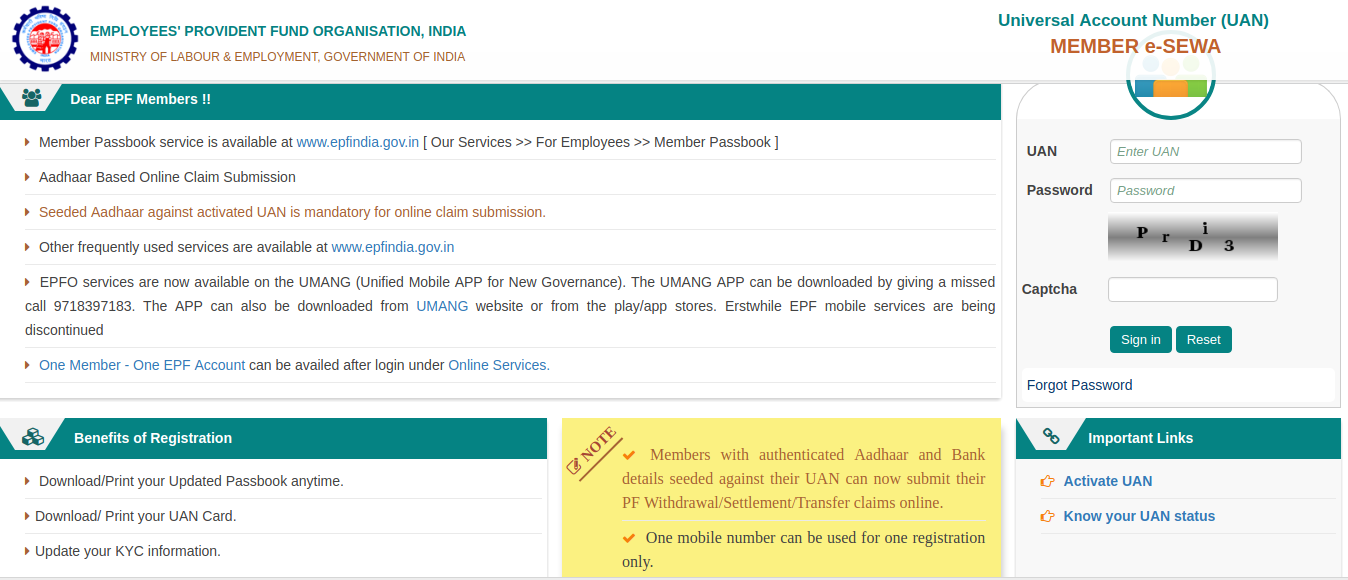

Sometimes, the employer is unable or either unwilling to furnish the UAN number information to you readily. This doesn't mean you have no means of getting to your UAN Number. UAN number can be obtained from the UAN Member Portal. Here are the steps to Check UAN Number Online:- Visit the UAN Portal Online to visit the portal.

Unified Portal maintained Employee Provident Fund Organization (EPFO)[/caption]

Unified Portal maintained Employee Provident Fund Organization (EPFO)[/caption]

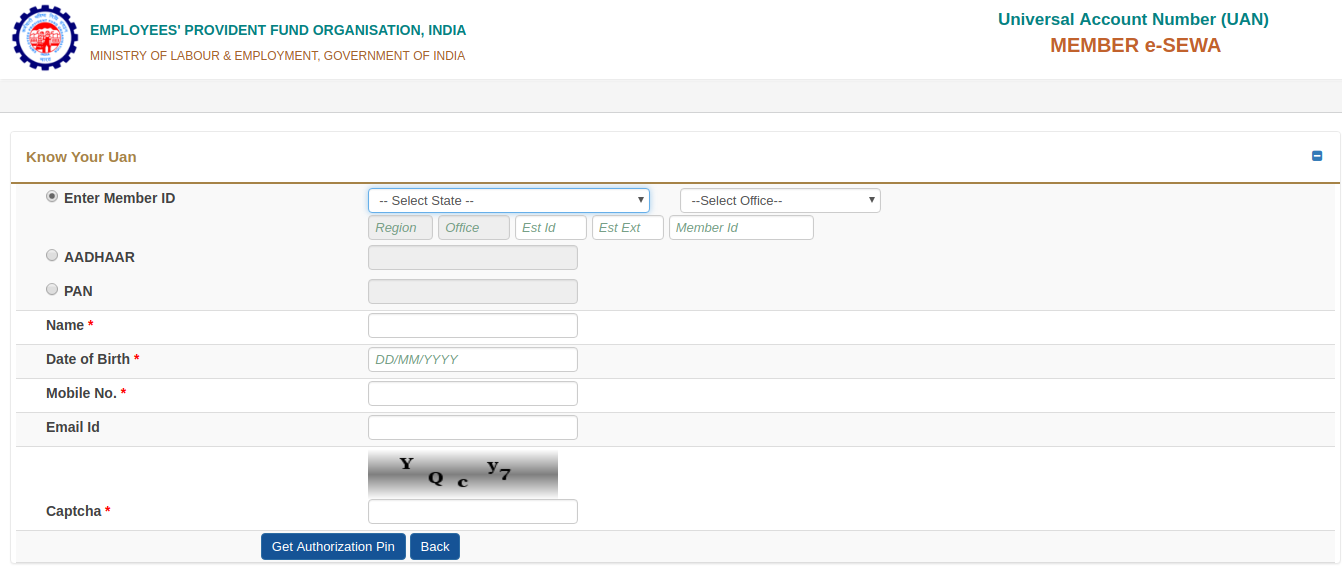

- In the bottom right there is a section called "Important Links" head on over to "Know your UAN status ". It should open up the following page.

UAN Status Page[/caption]

UAN Status Page[/caption]

- Select your relevant EPFO office, state of the office, in addition to this fill all relevant details like PF number/Member ID (On the salary Slip), Name, Phone Number, E-mail ID, Date of birth along with PAN Card/Aadhar details. Enter the captcha provided for you and click on Get Authorization Pin.

- OTP will be sent to you on your registered mobile number. This is done to authenticate and verify the mobile number.

- Click on 'Validate OTP and get UAN number'

- Your Universal Account Number will be sent to your registered mobile number

How to Create an EPFO Account

- Head on over to the EPFO online portal or UAN portal shown above. Under the important Links section find "Activate UAN"

- Enter your relevant details and click on "Get Authorization PIN"

- Authorization PIN will be sent to your entered mobile number, Enter PIN to activate UAN account

- You will be given a system-generated password once you have logged in. It is advisable to change this password immediately after the login.

Reset Password Procedure UAN Member Portal

- Click on “Forgot Password”

- Fill in your UAN and captcha code provided to you

- You will receive an OTP to your registered mobile number

- Enter given OTP and click 'Submit'

- Reset Password according to your wish and log in again

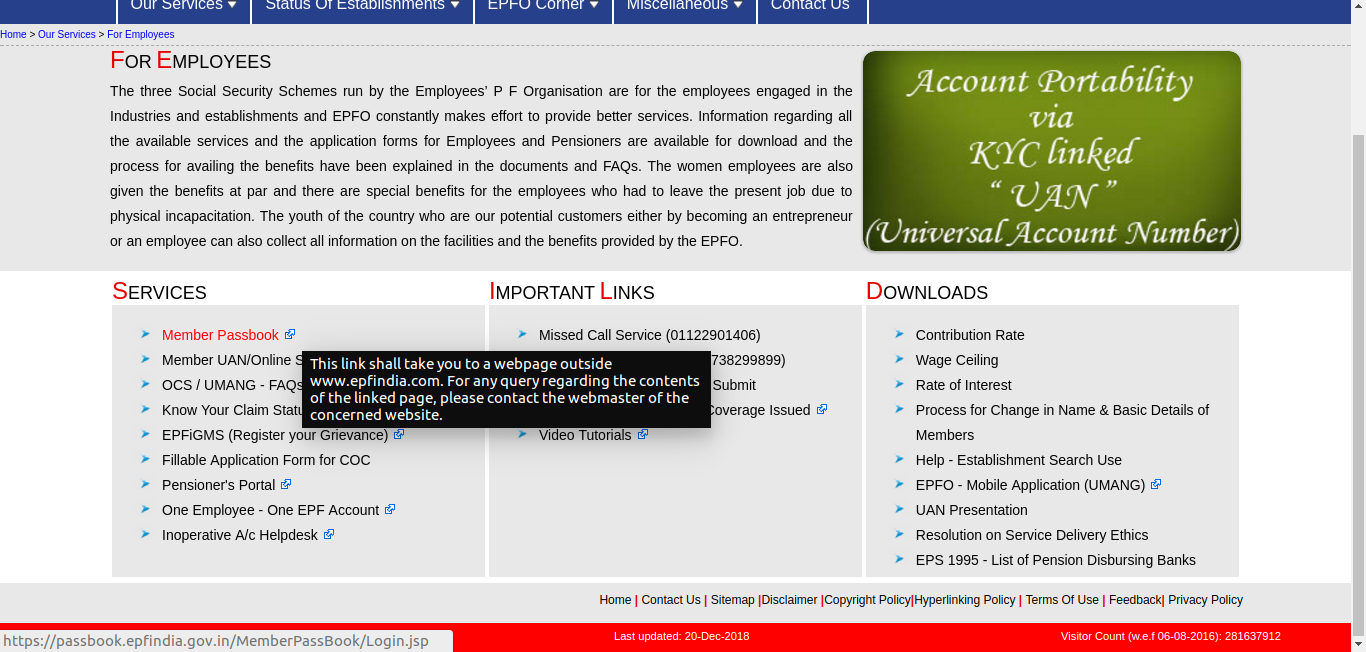

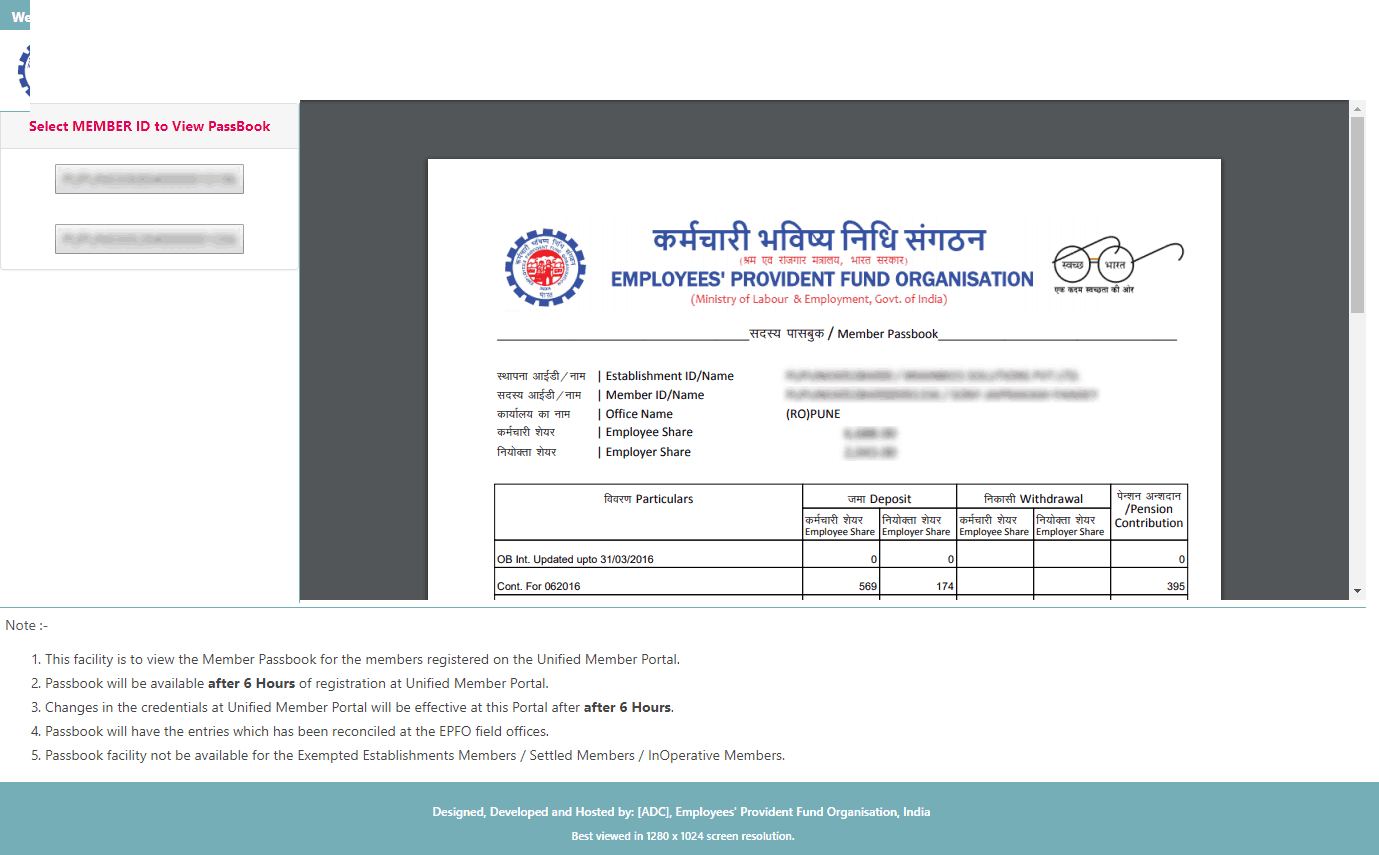

UAN Member Passbook Service

The UAN Member portal helps you see details like the UAN Number, KYC details, Profile and details of Service History. However, it is not possible to view the Member Passbook on this portal as it has not yet been made available. The UAN Member e-Sewa portal mentions on its homepage that the member passbook is available on the EPF India website.

- Click Here to visit the portal.

- Once you're on the portal click 'Our Services' and then Click 'For Employees'

EPF India Portal for UAN Member Passbook[/caption]

EPF India Portal for UAN Member Passbook[/caption]

- On the Main Page of the Portal, there will be an option of "Member Passbook"

Member Passbook Option[/caption]

Member Passbook Option[/caption]

- Click on the Link. It will redirect you to a new Page

- Enter Username, Password and the Captcha provided and you will be logged into your account.

- Click on the linked relevant Member ID to view the passbook details for that particular Member ID.

Member Passbook[/caption]

Member Passbook[/caption]

Documents for UAN member portal Registration

The documents required for UAN member portal registration are as follows:- Your bank account details – Account Number, IFSC Code, and Branch Name

- ID Proof: It could be any of the photo affixed and national Identity cards such as Driver’s License, Passport, Voter ID, Aadhaar Card, SSLC book (Secondary School Leaving Certificate).

- Residence Proof: It could be rental/lease agreement, ration card or any other ID proof mentioned above that has your current address mentioned on it.

- PAN Card: You need to link your PAN card with your UAN.

- Aadhar Card becomes mandatory since it is linked to both your bank account and mobile number.

- ESIC Card

UAN Advantages for Employees

- Each new registered PF account will fall under the umbrella of a single unified account.

- Through UAN online, there is lesser Employer Involvement in the withdrawal for PF.

- As the UAN is transferrable the PF of the old organization is linked to the new organization's PF as soon as the KYC verification is done.

- An employee only needs to provide his UAN details along with the corresponding KYC to link the old PF and the new PF accounts.

- Once details with UAN registered, you will be given a notification each time a contribution is made to your Provident Fund account.

- A total of up to 10 PF accounts can be merged with UAN number

- You can easily download EPF passbook which can show PF balance and can be used as a collateral/ basis for raising a loan

Features of UAN member portal

- UAN is used to centralize employee data in the country.

- It is very beneficial as it eases the task of employee verification for the employers and companies

- As an employer, it has made easier to get the bank account details and KYC of the members.

- You can also track the number of job switches by employees

- UAN has brought in check the untimely and early EPF withdrawals.

How to Transfer EPF Accounts using UAN member portal

The transfer of PF account using the UAN is mentioned below:- Check the PF eligibility and ensure all the present and previous employers’ records are presently online at EPFO

- Upload digital signature

- Then, you have to register yourself on the EPFO portal.

- After logging into the EPF member portal, select the option to transfer your account.

- Fill all three parts of the form.

- Select the attesting authority and member ID/UAN and click on “Get OTP”.

- You will receive an OTP to your registered mobile number. Enter this OTP to continue

- Your form will be submitted and you will get a tracking ID

- Take the print out of the transfer form and submit it to the current employer.

Some other Online services

Claim using form 31, 19 and 10 C

The EPFO has brought in different forms for partial/full withdrawal of PF. The only pre-requisite for this is that your Aadhar Card must be linked to UAN.Transfer

You have an option to transfer your PF amount from the previous one to the current one. For this, you need to make sure- That your KYC details are updated.

- That your current or previous bank account details and IFSC code is fed into UAN

Track EPF claim status

Along with this, you can also check the status of your EPF on the UAN portal login.UAN customer care

Any customer can contact the customer care team of UAN in case of any query or issue faced by them. You can choose any option given below:- Toll-free number: 1800 11 8005 (office timings are 9:15 AM to 5:45 PM)

- Email id: employeefeedback@epfindia.gov.in

- Website: www.epfindia.gov.in

- EPFO regional/sub-regional office http://www.epfindia.gov.in/site_en/Contact_us.php

About LegalRaasta

LegalRaasta is an online portal for simplifying legal compliances for Individuals as well as businesses. We help provide the quickest and most efficient legal registration for businesses like GST consultation, Food License, as well as, Company Formation with Trademark Filing. In addition to this, our services extend to efficient tax management such as GST returns, and Income Tax Returns ITR. Call +91 8750008585 or email us at contact@legalraasta.com with your requirements.

Read more on: How can UAN helpdesk serves you ? UAN Portal Login | How to change mobile number in UAN Portal | UAN Activation Online | UAN Registration & Procedure[fusion_builder_container admin_label="" hundred_percent="no" hundred_percent_height="no" hundred_percent_height_scroll="no" hundred_percent_height_center_content="yes" equal_height_columns="no" menu_anchor="" hide_on_mobile="small-visibility,medium-visibility,large-visibility" status="published" publish_date="" class="" id="" background_color="#eeeeee" background_image="" background_position="center center" background_repeat="no-repeat" fade="no" background_parallax="none" enable_mobile="no" parallax_speed="0.3" video_mp4="" video_webm="" video_ogv="" video_url="" video_aspect_ratio="16:9" video_loop="yes" video_mute="yes" video_preview_image="" border_size="" border_color="" border_style="solid" margin_top="0" margin_bottom="" padding_top="" padding_right="" padding_bottom="" padding_left=""][fusion_builder_row][fusion_builder_column type="1_1" layout="1_1" spacing="" center_content="no" hover_type="none" link="" min_height="" hide_on_mobile="small-visibility,medium-visibility,large-visibility" class="" id="" background_color="" background_image="" background_position="left top" background_repeat="no-repeat" border_size="0" border_color="" border_style="solid" border_position="all" padding_top="" padding_right="" padding_bottom="" padding_left="" margin_top="" margin_bottom="" animation_type="" animation_direction="left" animation_speed="0.3" animation_offset="" last="no"][fusion_text] [/fusion_text][/fusion_builder_column][fusion_builder_column type="1_1" layout="1_1" spacing="" center_content="no" hover_type="none" link="" min_height="" hide_on_mobile="small-visibility,medium-visibility,large-visibility" class="" id="" background_color="" background_image="" background_position="left top" background_repeat="no-repeat" border_size="0" border_color="" border_style="solid" border_position="all" padding_top="" padding_right="" padding_bottom="" padding_left="" animation_type="" animation_direction="left" animation_speed="0.3" animation_offset="" last="no"]