ROC filing due date : Meaning, forms, ITR, Consequences of not Filing

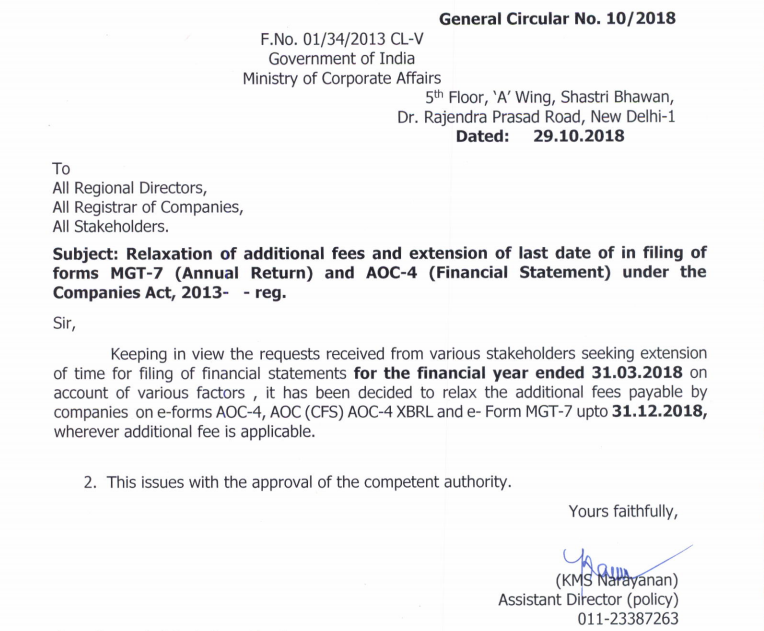

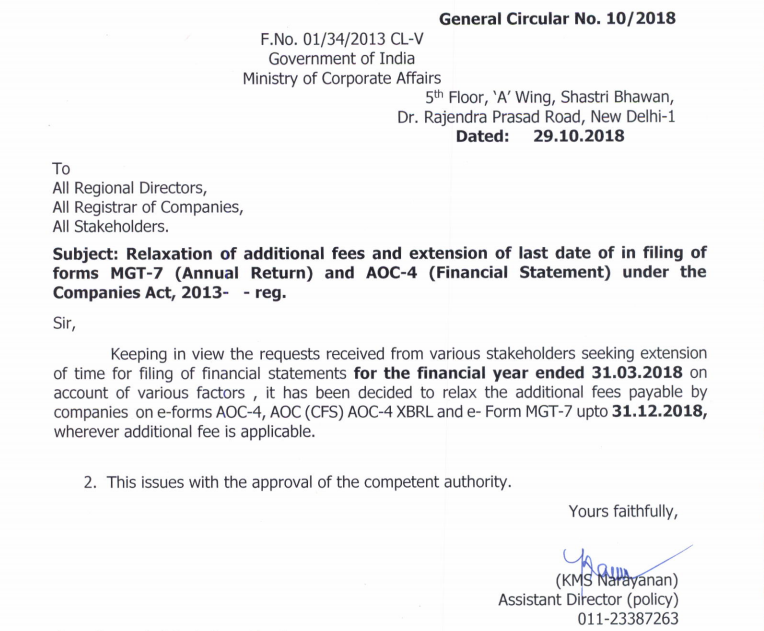

The Ministry of Corporate Affairs, in a statement, released on the 29

th of October 2018, has declared to favor the requests of the stakeholders by extending the Roc filing due date of Financial Statements and Annual Returns in the forms (details of which are provided below). The latest announcement allows the concerned companies to complete these obligations by the 31

stof December 2018. The concerned document for the

Roc filing due date extension is enclosed below:

Annual Return Due Date

All companies registered in India as a private limited company, one person company, limited company, and section 8 company must file their MCA annual return each year. Before filing the annual return, all companies also require to appoint an Auditor within 30 days of incorporation.

In addition, The filing of the annual turnover of the company done after having the

Annual General Meeting of the company. although, Newly established companies can conduct the first Annual General Meeting within 18 months from the date of establishment or 9 months from the date of closing of the financial year, whichever is earlier. Regular Annual General Meetings held within 6 months from the end of that financial year. So a Company’s annual return and other statutory filings as below would be due as follows:

ROC Filing Due Date(FY 2019-20)

| Name of the E-form |

Purpose of E-form |

Due Date |

Due Date for FY 2019-20 |

| Form ADT-1 |

Appointment of Auditor |

15 days from the conclusion of the Annual General Meeting |

15 October 2019 |

| Form AOC-4 |

Annual Accounts |

30 days from the conclusion of the Annual General Meeting (In the case of One Person Company within 180 days from the close of the financial year) |

30 October 2019 |

| Form MGT-7 |

Annual Return |

60 days from the conclusion of the Annual General Meeting |

29th November 2019 |

| Form CRA-4 |

Cost Audit Report |

30 days after the receipt of Cost Audit Report |

30 days from

the receipt of

Cost Audit

Report |

| Form MGT-14 |

Board Report and Annual Accounts |

30 days after the date of Board Meeting |

30 days from the date of Board Meeting |

ROC Meaning

The full form of

ROC, Registrar of Companies, which administers the office under the Ministry of corporate affairs, as well as, the

registration of companies come under MCA, and

Limited Liability Partnerships. The ROC as the name suggests is the registry of records, identifying with the companies listed with them accessible for assessment by individuals from open on installment charge. As of today, all over the country, there is over 22 Registrar of Companies established in the major states. For the administration of the companies, ROC is so important that some states such as Tamil Nadu and Maharashtra, have more than one ROC. Under the

Companies Act, 2013 the

ROC compliances are mandated. The Companies Act states that it is the duty of the ROC to register Private limited companies in addition to granting LLP Registration to eligible business institutions.ROC filing due date is stated in the table above. While filing ROC one has to submit the above-mentioned forms. Therefore, you should remember ROC filing due date to stay away from any problem.

You can register your company as an LLP company using our Legal Raasta services:

LLP Registration

ROC Filling Forms

Under Annual Filing Compliances of the ROC, given below are the forms. You have to file these forms before the ROC filing due date.

Form 23AC (Balance Sheet) & Form 23 ACA (Profit and Loss Account)

As soon as the Annual General Meeting is conducted, within 30 days, A Copy of the Balance Sheet has to be recorded with the Registrar of Companies. If in case the Annual General Meeting is not conducted, the duplicate of the balance sheet has to be registered within 30 days from the date of conducting the meeting. In addition to this, a statement of the reality and the reasons must also be attached alongside the balance sheet.

FORM 23AC

FORM 23ACA

Form 20B OR Form 21A (Annual Returns)

The annual Return form should be stated with the ROC in an electronic mode within 60 days from the date of holding the annual general meeting. When the annual general meeting has not been held, the return is required to be documented within 60 days from the date on which the annual general meeting ought to be held. According to sec 161, the return should be appropriately marked and the important documents to be joined.

FORM 20B

FORM 21A

Form 66 (Compliance Certificate)

Certain companies that have paid up share capital for the year in the range of Rs. 10 lakhs to 50 crores are required to record a Compliance Certificate in Form 66.

FORM 66

Income Tax Return

In addition to the Ministry of Corporate Affairs annual return, companies must also file for the income tax return irrespective of their business turnover, income, profit or loss. Hence, even the dormant companies with no transactions have to file an income tax return each year in the ITR-6 form. The due date for filing income tax returns for the companies is on or before the 30th of September.

The Ministry of Corporate Affairs annual return filing relaxation for newly established companies between 1st January – 31st March is not applicable under the Income Tax Act. Hence, even a company set up on 25th March must file its income tax return for the whole financial year on or before 30th September.

Consequences of not filing Annual Return

For Directors

Director Disqualification: If a company has not filed its Annual Return for three continuous financial years, then every person who has been a director or currently the director of the specific company could be disqualified under the Companies Act, 2013. If a Director is disqualified, his/her

Director Identification Number would become inactive and the person would not be eligible to be a Director of any company for a period of five years from the date of disqualification. Further, disqualified Directors would also not be allowed to join another company for a period of five years. Thus, Directors should file the forms before the ROC filing due date.

Fine and Imprisonment: A director of the company can be punished if the company has not been filed in government files even after 270 days from the date when the company should have originally filed with an additional penalty on the director of the company. Any Director who has been defaulted in the filing of annual return of the company can be punished with the imprisonment of a term extended up to six months.

For Company

Penalty: The Government fee for filing any document under the Companies Act 2013 with the Registrar is Rs.200. A private limited company has to file form MGT-7 and form AOC-4 each year and the government fee for filing would be Rs.400 if done on time.

Strike off: If Company has not filed its Annual Return for the preceding two financial years continuously, then such companies would be named as an “inactive company”

For more details related to audit reports,

ITR,

accounting and bookkeeping services, visit our website:

LegalRaasta. We also provide a wide range of CA/CS services including

ROC compliances like

MGT-7 filing. Call us with your requirements at

+91-8750008585 or drop an e-mail at

contact@legalraasta.com.

Related posts

ITR Forms

Types of Return Filing

Income Tax Audit