How to apply for an online PAN card Application form

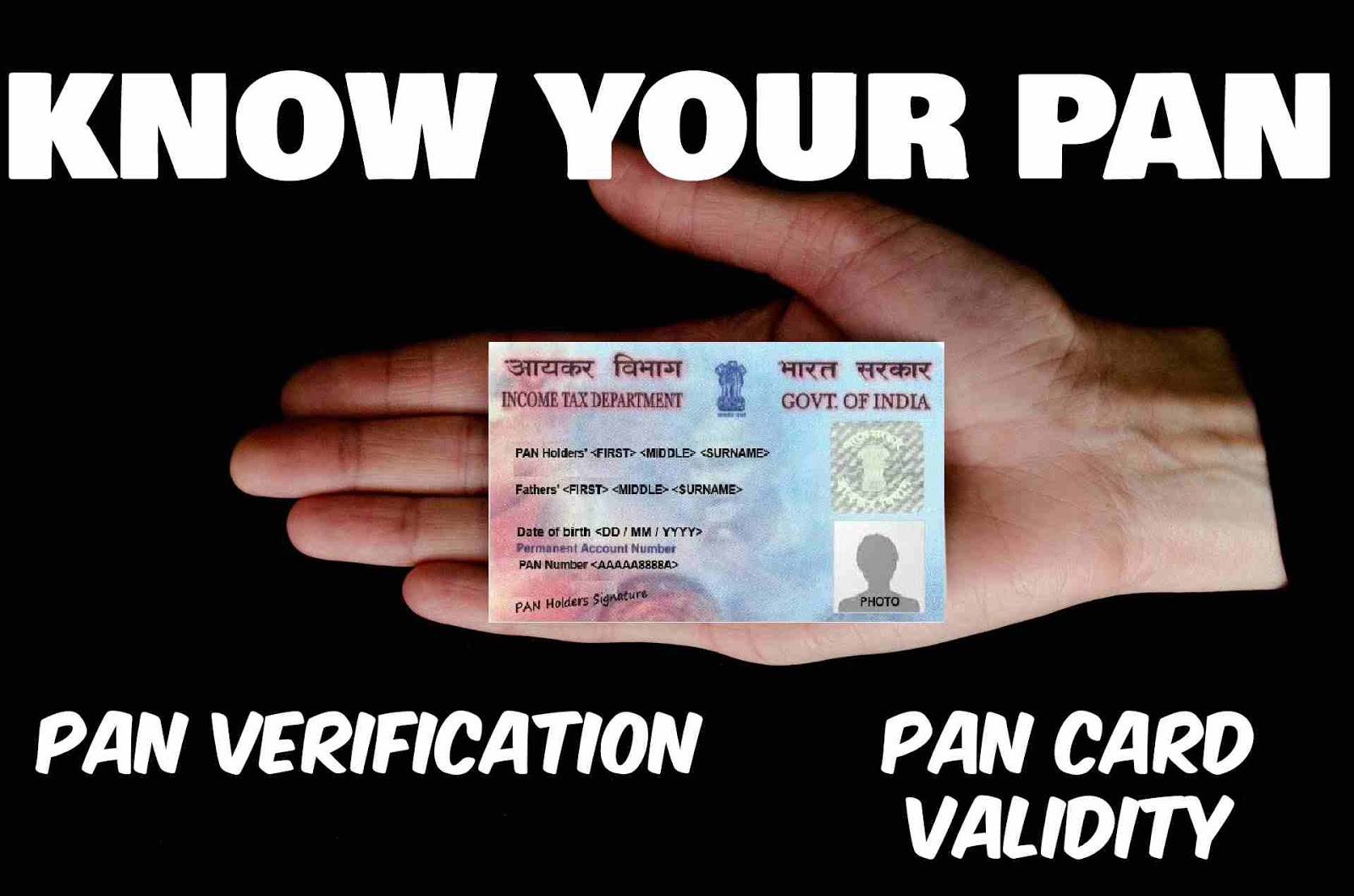

PAN stands for Permanent Account number which is a nationalized identity card. If you are not having PAN, you will not be able to carry out any financial transaction. The Indian Income Tax Department allocates this 10-digit alphanumeric and unique account number to a tax-paying person, company or HUF. The validity of the PAN card is for a lifetime. In this article, we will discuss the procedure of online PAN card application form. So, let us discuss in brief:How to Apply for PAN card application form?

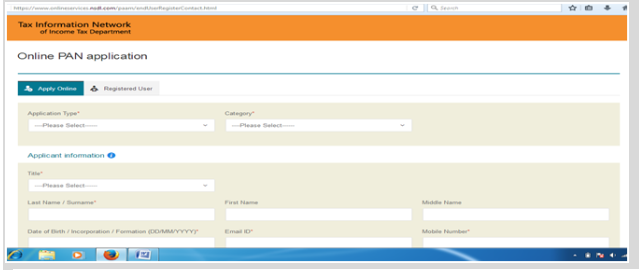

PAN registration can be done online. But we at LegalRaasta excel to lessen your burden and the pain of indulging in all these cumbersome processes. We will do the procedure on behalf of you in a very simple method just in 15 days. Moreover, requests for changes or correction in PAN data may also be made online. But for the knowledge sake here is the online procedure of PAN card application form. This form can be found on the NSDL website or UTIITSL website. Both the websites are authorized by the government of India to issue the PAN as well as to make changes/corrections in the PAN on behalf of the Income Tax Department. All you need to fill the form and submit the online application form along with online payment of the respective processing fee. For verification, documents can then be sent by post to either NSDL or UTIITSL. Following are the steps to follow for PAN card application form: STEP 1. All you need to submit the PAN card application form 49A available on the NSDL website: https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html STEP 2.

Now, fill all the details in the given form. Do not to forget to read the detailed instructions before furnishing the details in the form. https://tin.tin.nsdl.com/pan/Instructions49A.html#instruct_form49A

STEP 3.

The fees for applying PAN is Rs.93 (excluding GST) for Indian communication address and Rs. 864 (excluding GST) for foreign communication address. You are free to make payment from any mode whether through credit/debit card, demand draft or net banking. The acknowledgment will be displayed when the payment would be successful. Now, save that acknowledgment number.

STEP 4.

When the payment will be accepted along with the PAN card application form, you are required to send the supporting documents through courier/post to NSDL. The PAN application would be processed by NSDL only after the receipt of the documents.

Here you can download the complete list of documents for PAN Card:

STEP 2.

Now, fill all the details in the given form. Do not to forget to read the detailed instructions before furnishing the details in the form. https://tin.tin.nsdl.com/pan/Instructions49A.html#instruct_form49A

STEP 3.

The fees for applying PAN is Rs.93 (excluding GST) for Indian communication address and Rs. 864 (excluding GST) for foreign communication address. You are free to make payment from any mode whether through credit/debit card, demand draft or net banking. The acknowledgment will be displayed when the payment would be successful. Now, save that acknowledgment number.

STEP 4.

When the payment will be accepted along with the PAN card application form, you are required to send the supporting documents through courier/post to NSDL. The PAN application would be processed by NSDL only after the receipt of the documents.

Here you can download the complete list of documents for PAN Card:

How to make Changes/corrections in PAN card

In case, if you want to make any changes in the existing PAN card or want to correct any mistake such as the name, date of birth etc then you are free to apply for it online. Almost the procedure will remain the same as applying for new PAN card except in case of corrections in PAN, you also need to submit the documents to support the changes required in PAN. Following the given below steps for making corrections in your existing PAN card: STEP 1. All you need to fill the form for making corrections on the NSDL website: https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html But read the instructions carefully while filing the form at https://www.tin-nsdl.com/services/pan/instructions-change.html STEP 2. The fee for making corrections will remain the same i.e Rs. 93 (excluding GST) for Indian communication address and Rs. 864 (excluding GST) for foreign communication address. You can make the payment through either credit/debit card or net banking. Rest the process will be the same. STEP 3. As soon as the application and payment are accepted, you have to send the supporting documents through courier/post to NSDL. The PAN application would be processed by NSDL only after the receipt of the documents. Your sent documents would support your changes applied for in PAN. Following are the documents that shall be accepted as proof in this case:- In the case of Married ladies: Marriage certificate, Marriage invitation card, Publication of "name-change" in the Gazette, a certificate from a gazetted officer stating name change, a copy of passport showing husband's name.

- For other than Married ladies: Its only publication of "name-change" in the Gazette, a certificate from a gazetted officer stating name change.

- For companies: ROC's certificate for the name change is required.

- For Partnership firms: Only a copy of a revised Partnership Deed is sufficient.

- For other categories which are registered organizations (AOP/Trust/BOI/AJP etc): Revised registration/deed/agreement.

Related Articles: All you need to know about your PAN Card with Legal RaastaHow to Check the PAN Card Status Online

Delhi marriage certificate: requirements, procedure & charges for registration