All you need to know your PAN Card with Legal Raasta

Permanent Account Number (PAN)

PAN is basically a unique 10 digit identification number allotted to every person who has applied for it. Besides, it is introduced to track financial transactions taxable in nature.

PAN card registration also serves you as an identity proof in checking on tax evasion. This is the primary key for storage of information and is shared across the country. Therefore, no two tax paying entities can have the same PAN. But have you ever think, what if lost your PAN Card being a PAN holder and you need the number for some specific purpose. To solve this situation, the Income-tax department has provided an alternative for you to get your PAN with the help of certain personal details while applying for PAN. This article is based on how to get to know your PAN.

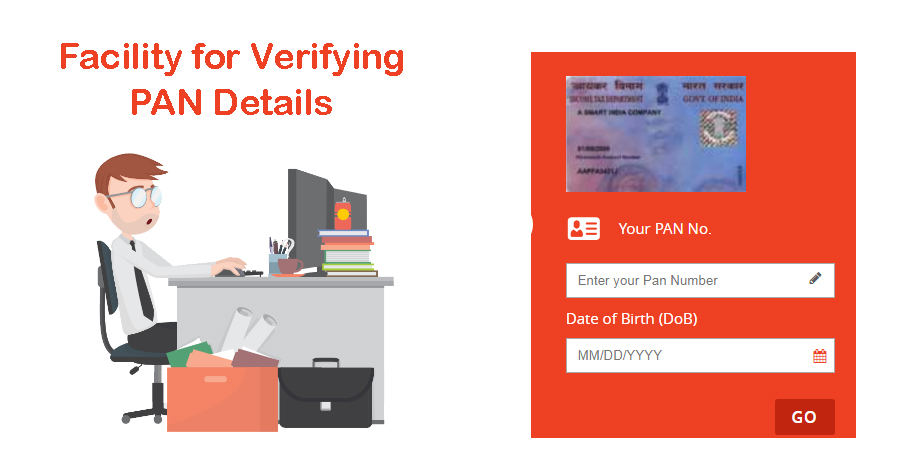

How to Know your PAN?

Follow the given steps to know your PAN:

STEP 1.

Go to

Income tax India e-filing

STEP 2.

STEP 2.

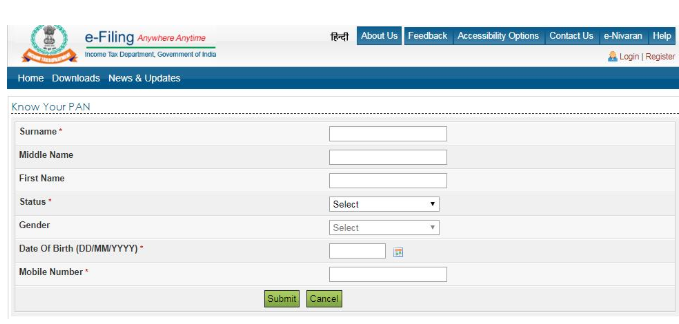

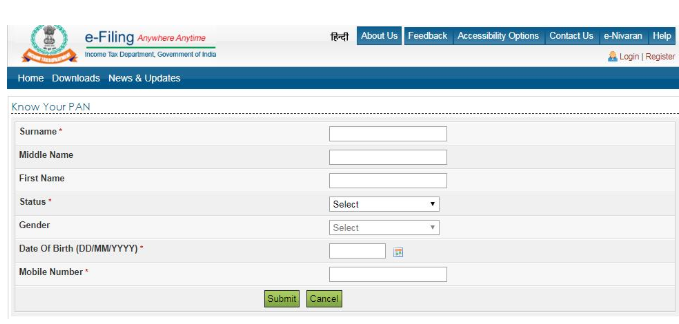

Now, enter your first name, middle name, surname according to PAN application.

STEP 3.

Select the Status from the given drop-down such as individual, Hindu Un-divided family, Association of persons, Body of Individuals, Company, Government, Artificial Juridical Person, Local Authority, Firm or Trust.

STEP 4.

Select your ‘Gender’. It is optional as it is specific only to individuals.

STEP 5.

Mention your date of birth.

STEP 6.

Text the active mobile number as OTP will be sent to this mobile number and then click on ‘submit’.

STEP 7.

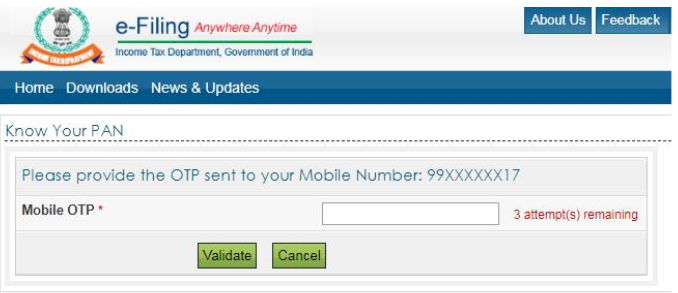

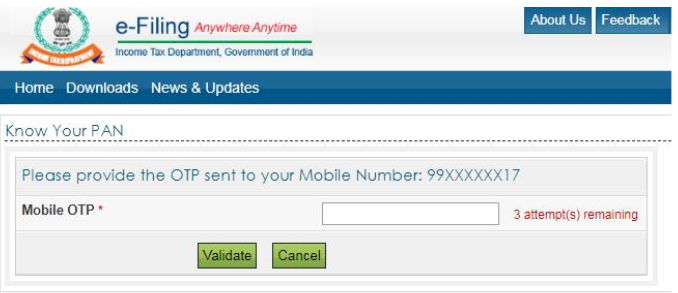

Now, an OTP will be sent to your mobile number. All you need to do is just enter that OTP number and click on ‘Validate’.

STEP 8.

STEP 8.

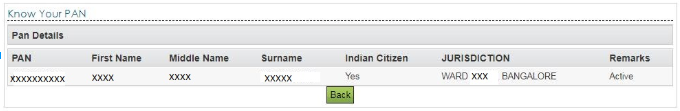

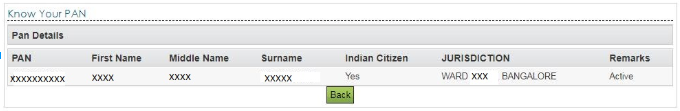

At last, PAN, Jurisdiction, and status of PAN would appear on your screen.

Read more here to know about How to track the online status of PAN card

Read more here to know about How to track the online status of PAN card

Advantages of PAN Card

Actually,

PAN card registration is mandatory for every taxpayer in India because of its varied uses and perks. Given below are some important need and uses of PAN Card in India:

- A taxpayer who wishes to pay direct taxes must have a PAN.

- For starting a new business venture, details of PAN is compulsory.

- For the payment of income tax, PAN Card is a must.

- For undertaking different financial transactions, details of PAN is required. By financial transaction, we mean like sale or purchase of a vehicle, buying a property etc.

There are many financial transactions also that are given below:

- Transferring Fund from NRE to NRO account.

- Global remittance of money.

- Buy an insurance policy of Rs. 50000 or more.

- Purchase shares for Rs, 50000 or more.

- Selling and purchasing of immovable property of Rs. 5 lakhs or more.

- Selling and purchasing of a vehicle other than a two-wheeler.

- Bill payment of hotel or restaurant having a value of Rs. 25000 or more.

- Buy schemes of mutual funds.

- Bank deposits of Rs. 50000 or more.

- It is an identity proof of the taxpayer.

- A taxpayer can keep a check on the tax payment.

- PAN Card can be used to opt connection like the internet, telephone etc.

- Financial transactions can be traced by the taxpayer with the help of the PAN Number.

What is the validity of PAN Card?

There is no expiry date of PAN Card. It is valid for the lifetime of the person throughout India.

For further more details regarding

filing application for Pan Card,

Pan card registration,

TAN registration, you can visit our website:

LegalRaasta and follow our

blog. Our experts will help you to get your registration done with ease and hassle-free manner. Hurry up! Give us a call at

8750008585 and feel free to send your query on Email:

contact@legalraasta.com

Related Articles:

Get Your PAN, TAN registration within 24hrs

Difference between TAN, PAN, DSC and DIN

Documents required to obtain TAN

STEP 2.

Now, enter your first name, middle name, surname according to PAN application.

STEP 3.

Select the Status from the given drop-down such as individual, Hindu Un-divided family, Association of persons, Body of Individuals, Company, Government, Artificial Juridical Person, Local Authority, Firm or Trust.

STEP 4.

Select your ‘Gender’. It is optional as it is specific only to individuals.

STEP 5.

Mention your date of birth.

STEP 6.

Text the active mobile number as OTP will be sent to this mobile number and then click on ‘submit’.

STEP 7.

Now, an OTP will be sent to your mobile number. All you need to do is just enter that OTP number and click on ‘Validate’.

STEP 2.

Now, enter your first name, middle name, surname according to PAN application.

STEP 3.

Select the Status from the given drop-down such as individual, Hindu Un-divided family, Association of persons, Body of Individuals, Company, Government, Artificial Juridical Person, Local Authority, Firm or Trust.

STEP 4.

Select your ‘Gender’. It is optional as it is specific only to individuals.

STEP 5.

Mention your date of birth.

STEP 6.

Text the active mobile number as OTP will be sent to this mobile number and then click on ‘submit’.

STEP 7.

Now, an OTP will be sent to your mobile number. All you need to do is just enter that OTP number and click on ‘Validate’.

STEP 8.

At last, PAN, Jurisdiction, and status of PAN would appear on your screen.

STEP 8.

At last, PAN, Jurisdiction, and status of PAN would appear on your screen.

Read more here to know about How to track the online status of PAN card

Read more here to know about How to track the online status of PAN card