Income Tax Return Filings rise by 26% for FY 2017-18

Tax Taboo

Let's face the facts, The Government of India is no stranger to the problem of tax evasion, willful defaulters and black money hoarders. Few of these steps government has taken famously include Crackdown on Shell companies, Amendments to the Benami Properties Act i.e. RERA and demonetization. Seen individually these steps don't seem to have accomplished a lot. However, seen as an overall change in policy along with the GST regime, these steps by the government have increased the tax base of the country significantly. A great indicator of the positive impact is that the number of income tax return filings in the year after demonetization stood at 10.1 million as compared to the average of past 6 years i.e. 6.2 million which is a significant rise of up to 1.5 times before the policy implementation.

Positive Signs for Income Tax return Filings

Say what you will about the inconvenience GST or demonetization caused at the time of implementation, there have been quite a few positive impacts of all these amendments and changes. One of the areas affected for the better is the Income Tax department. According to recent reports, the tax collection has risen by a staggering 18% for the Fiscal Year 2017-18. The government reportedly set an 'ambitious' target of achieving Rs. 10 lakh Crore through collections in indirect taxes. Much to everyone's surprise, the government achieved their targets and collected over Rs 10.03 lakh Crore in indirect taxes.

In the year of 2016-17, the number of taxpayers was recorded at 5.61 crores which rose to 6.92 crores in 2017-18 a brilliant rise of about 26%. The government basically received 1.06 Crore new income tax return filings in 2017-18 and have aimed at 1.25 Crore new filings for the current Fiscal year of 2018-19. ITR filing thus becomes a vital procedure since the government is actively working on its reforms. This is another step in the right direction for the policymakers to eradicate the issues of black money, money laundering as well as misuse of financial resources. It also helps account for defaulters in a more streamlined fashion.

The main reason for such huge strides the Income Tax Department is making is because of the change of structure and it's reforms accredited to the ' inconvenient ' implementation of GST and demonetization. These amendments have helped to improve the tax base of the country.

The Road Ahead

Even though there have been significant improvements and effective measures have been taken to improve the taxation system in India. There is still a long way to go for the taxation system in India to eradicate the dealings of tax in bad faith. Reports also show that the tax collection in the country is highly undemocratic. The tax majorly comes from the biggest cosmopolitan cities in the country.

The states of Maharashtra and Delhi put together contributed over 53% of total tax income generated. This served as a sign of worry for the government. In order to help facilitate income tax return filings, the government decided to deploy offices across the country. As a result, the revenue from remote areas of the country i.e. North-East rose by a whopping Rs 7,097 Crores.

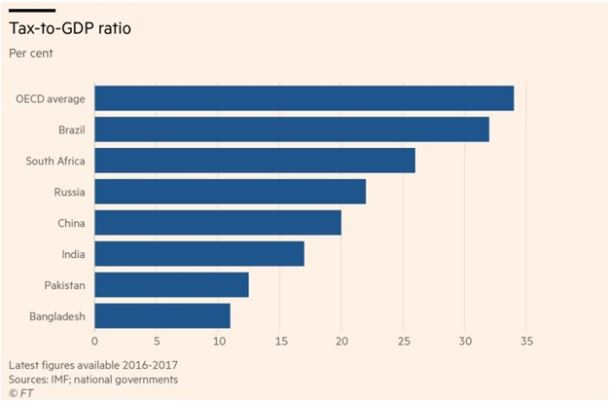

A mere rise in tax revenue, however, is not as glorious as it sounds. Figures indicate that India is among one of the countries with a very low 'Tax to GDP' ratio. This indicates that the government is not able to provide basic amenities to its citizens including food, education or healthcare. A country-wide access to these amenities is pivotal for a developing economy of ours to become a developed nation. Below is an infographic outlining how much India is lacking behind in terms of tax to GDP ratio.

[caption id="attachment_14525" align="aligncenter" width="612"] Tax to GDP ratios indicate a grim reality for India[/caption]

India still has a long way to go to transform the economy into a developed economy. However, some positive steps give hope for a better future.

Tax to GDP ratios indicate a grim reality for India[/caption]

India still has a long way to go to transform the economy into a developed economy. However, some positive steps give hope for a better future.

Still, haven't filed your ITR? File your Income Tax Returns with the help of LegalRaasta for all things related to taxation such as GST registration. We also help with all things corporate like Company Registration as well as Trademark Registration. Call us with your requirements at +91-8750008585 or drop a mail at contact@legalraasta.com.