Flipkart Seller Registration: How to Sell on Flipkart

Flipkart and the World of Online Shopping

Flipkart, Amazon, Snapdeal, Shopclues, Myntra, Jabong are all a means to an end, your favorite goodies hand delivered to you at the comfort of your homes. The advent of e-Commerce has made life much simpler for shoppers to get their desired goods. Flipkart, one of the big players in the e-commerce landscape of India, hit close to $18 billion(~ ₹1300 Crores) in revenue in 2017-18. In this article, we will discuss how you can be a Flipkart seller.

As of this day, Flipkart makes close to 5 million shipments every month and every day at least 1 crore people visit their website/open the app. These e-commerce portal have made many incentives, schemes, special offers and discounts to help encourage people using their portals. Incentives like "Big Billion Days ", OneDay Delivery etc. have made Flipkart a lot of revenue. In the first hour of the "Flipkart Sale" nearly 1 million smartphones were sold that is ₹1000 Crores in one hour. This presents businessmen and traders with a great opportunity to sell their products online. Let's see the process of becoming a Flipkart Seller.

Becoming a Flipkart Seller

The process for becoming a seller on Flipkart is very easy and can be done in a few simple steps. Any individual trader/business can sign up as a seller on the e-commerce website by specifying information about the type of the operation they are running i.e. the type of association.- First of all, you need to go to the Flipkart Website and their seller registration page. Click here to go to the seller page

- Be ready with the following details to be filled up at the time of registration.

- Name of individual/Organization Selling the products

- Phone Number of Seller

- E-mail address

- Business Address/ Pickup address

- Classification of products that seller is proposing to sell via Flipkart

- Tax registration Proof. Specifically GST Registration as well the Identification Number for GST also called GSTIN.

- Proof of Business Registration such as Certificate of Incorporation or Memorandum of Association

- Personal PAN Card Number for "Proprietorship " type business Go to: Proprietorship Registration, also if you haven't yet, apply for PAN Card

- Bank Account and KYC supporting Documents like Address Proof, Cancelled Cheque (Providing details like Bank Account Number, IFSC Code)

- Once you are done with filling up the details of the business, registration, documents etc, Fill up the classification of products you are going to sell on the platform. Set up the storefront, and commence selling operations

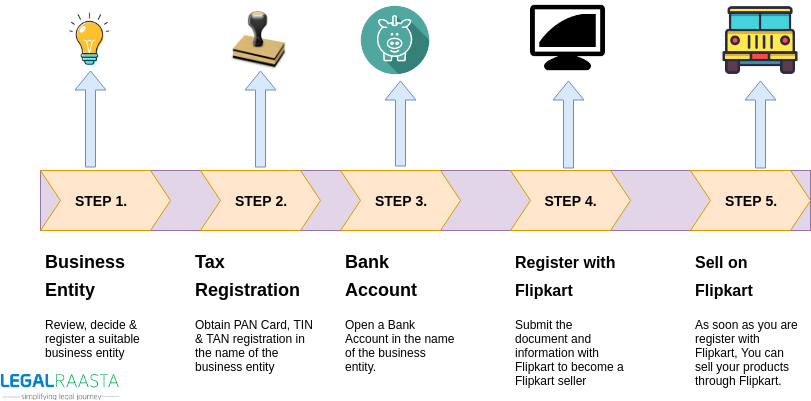

Steps portraying the procedure of being a seller on Flipkart

Documents Required to become a seller at Flipkart

If the seller decides to sell in his own name and legal standings, the business will automatically be professed to be a sole proprietorship business. In case of Individual or a Proprietor There is no limited liability and no protection is provided to the promoter. Besides, it is not easily transferable and cannot have investors and partners. Following are the documents for sole proprietor or individual:- Passport of the proprietor

- PAN Card copy

- Voter’s ID/ Driving License

- A declaration by the proprietor declaring that the business account is operated by himself.

- License or lease agreement

- Bank Account Statement

- Telephone bill / Electricity bill pertaining to the proprietor

- Partnership or LLP Registration Certificate

- Partnership Deed

- Power of Attorney granted to a partner or an employee of the firm to transact the business

- PAN Card of the partnership or the LLP

- Document validating the address of the partners and the person holding the power of attorney

- Lease or Rental Agreement

- License Agreement

- Firm’s or partner’s Electricity Bill/ Telephone Bill

- Copy of Certificate of Incorporation

- Copy of Memorandum of Association

- Company’s PAN Card

- Company’s Telephone Bill/ Electricity Bill

- Lease or Rental Agreement

Flipkart Seller - Requirement for Tax Registration

Following are the Tax registration and Bank account in the name of the business or entity is required when the Flipkart seller is registered as a suitable business entity for the proposed business:- Business name

- PAN – PAN Card of the individual or private limited company or partnership firms

- TIN – TIN Number is also known as VAT Number / Sales Tax Number / CST Number in the name of the business

- TAN – TAN is required for Tax Deduction at Source (TDS) – in the name of a business

- Bank account name

- Bank account number

- Bank IFSC code

Start selling on Flipkart

As soon as you provided the above documents and information about your business, you will be registered. Then you can smoothly commence selling of its products on Flipkart. By completing the Flipkart seller registration account, the business is officially allowed to set up the storefront and list products to sell on Flipkart to start sales.Basic Advantages of being a Flipkart seller

Following are the advantages of being a Flipkart seller:-

Reach to numerous Customers

-

Quick mode of payments

-

Dedicated pick-up services

-

Timely reward programme

Bifurcation of Flipkart seller fees

Let us assume that selling price of a product is Rs. 1000 (decided by the seller), Given below is the bifurcation of the fees: [fusion_table fusion_table_type="1" hide_on_mobile="small-visibility,medium-visibility,large-visibility" class="" id="" animation_type="" animation_direction="left" animation_speed="0.3" animation_offset=""]| S.No | Particulars | Amount (Rs.) |

|---|---|---|

| 1. | Selling Price | 1000 |

| 2. | Flipkart Commission | 50 (5% – assumed) |

| 3. | Shipping Fee | 30 |

| 4. | Fixed Closing Fee (fixed by Flipkart) | 10 |

| 5. | Total Marketplace Fee (2+3+4) | 90 |

| 6. | GST (rate can varies product to product) | 50 |

| 7. | Total Deductions (2+3+4+5)= 6 | 140 |

| 8. | Settlement Value (Credit to seller) (1-6) | 860 |

Concept of GST for online sellers

Earlier, the seller used to give VAT/CST to the government. But with the introduction of GST, operators like Flipkart who is booming e-commerce in India started collecting the amount at the rate of 1% that contain 0.5% as CGST + 0.5% as SGST of the net value of taxable supplies. So, in the end, the amount collected is called Tax collected at source (TCS). There is a slight change now that TCS will be applied on one month's collection which will be paid to the Government. It will be clearly seen in the GSTR-2 of the registered supplier on behalf of whom the collection is done. All you (seller) need to do is to submit an online statement, which has the details of all the products sold through the portal and the TCS in Form GSTR-8. So, the details furnished by the operator in his form will be matched with that of the respective seller in his form. For more information regarding LegalRaasta, you can visit our website. Our experts are available here to provide you with the best advice on GST Registration, GST return or more. Just give us a call at 8750008585 and send your query on Email: [email protected]Related Articles: How to get GST registration with the help of LegalRaasta? LR GST Helper extension GST impact on startups