Export Procedure and the documents required in India

Export and Import in India

When it comes to talking about Import and Export, India ranks 19th in terms of overall export of merchandise and 12th in terms of the overall import of merchandise in comparison with the other countries. The most favored mode of entering into International Business is Import and Export. The government has provided liberalization to expand the trade procedures occurring in India. There is plenty of opportunity for establishing a successful import or export businesses in a smooth way. To carry forward the export procedure, the Entrepreneur must have a strong understanding of all documentation pertaining to import or export transactions. Let us first discuss the Export meaning:

What is Export?

An export procedure is basically a movement of items outside the country which includes the items sent by regular mail or hand-carried on an airplane, documents transmitted by fax, software or specifications downloaded from the internet, and technology transmitted by email or shared in a phone conversation. If the item is leaving the U.S temporarily or if it is being returned to a foreign country then that "item" will be considered as the "export". Ultimately, releasing technology or data to a foreign national located in the U.S. is also “deemed” to be an export.

Also read:

Import Export Code Exemptions in India

Export Procedure and the documents required

For being a free floater of Export and Import in India, one needs to obtain first the

IEC Code from the Directorate General of Foreign Trade. Import and Export code (IE Code) can be obtained by the business after obtaining PAN and opening a bank account.

LegalRaasta can help you obtain

IE Code in a hassle-free manner.

Read more:

Ways to overcome negative thoughts in Export Business?

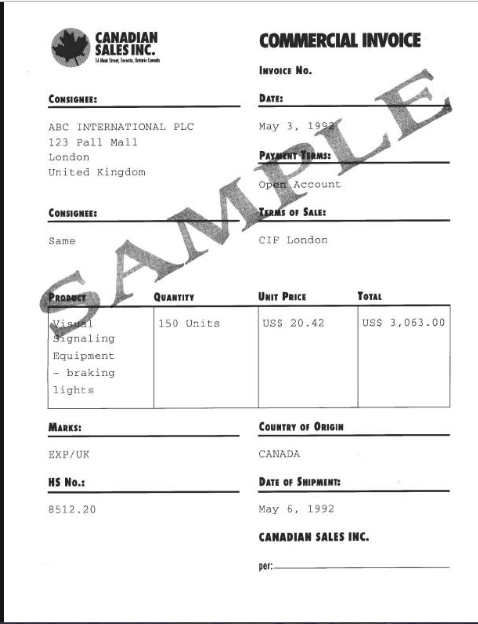

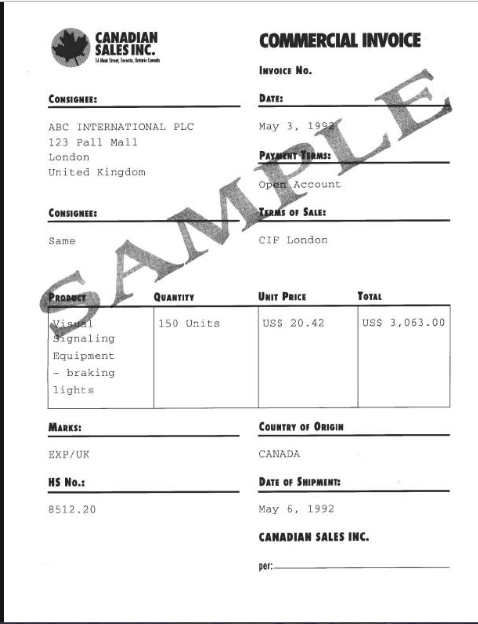

Commercial Invoice

It is issued by the seller to the buyer containing the terms of the transaction such as date of seller details, transaction, buyer details, value, shipping terms and more. On the other hand, Customs duty is levied on the shipment usually based on the commercial invoice raised by the seller.

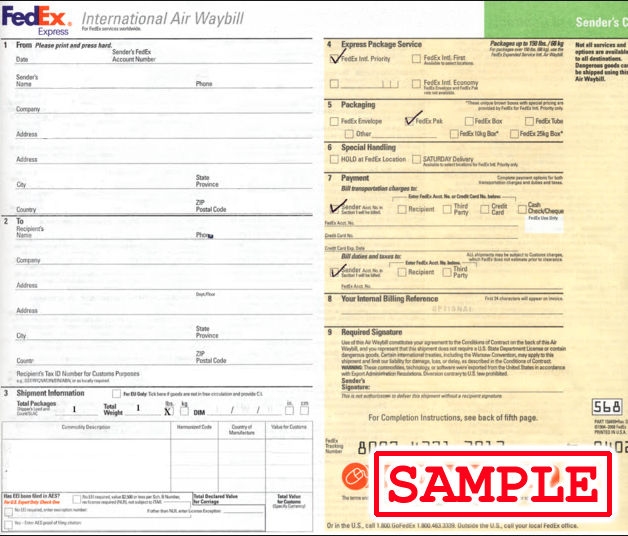

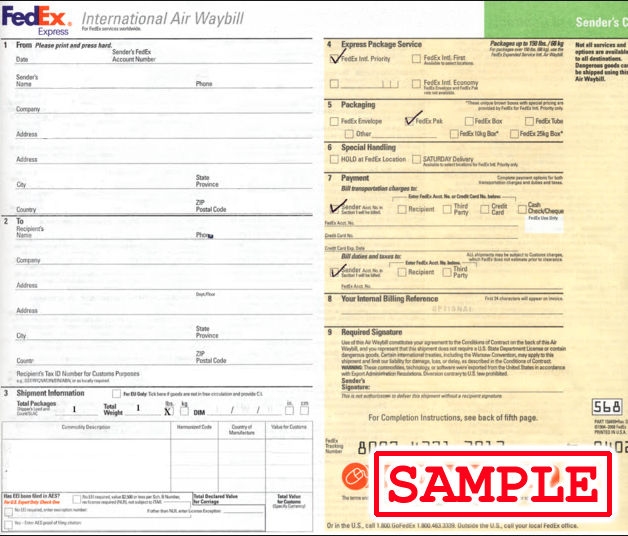

Air Waybills

It is a proof of shipment of goods by air. Air waybills serve as a proof of receipt of goods for shipment by the air cargo agent, an invoice for the air shipment, a certificate of insurance and a guide to the air cargo agent for handling, dispatch, and delivery of the consignment. Actually, it contains the information about the shipper and the consignee, the departure airport and destination airport, sign, description of the goods and seal of the carrier.

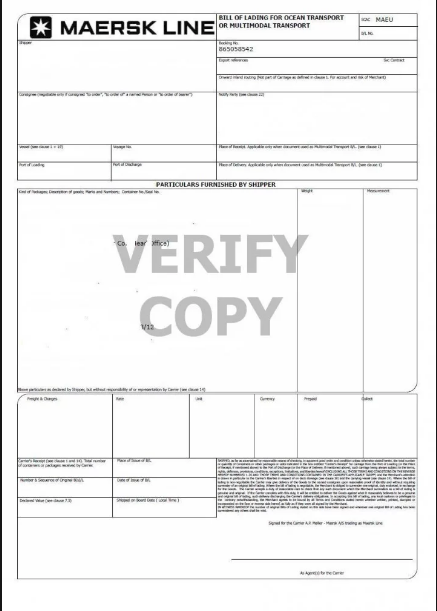

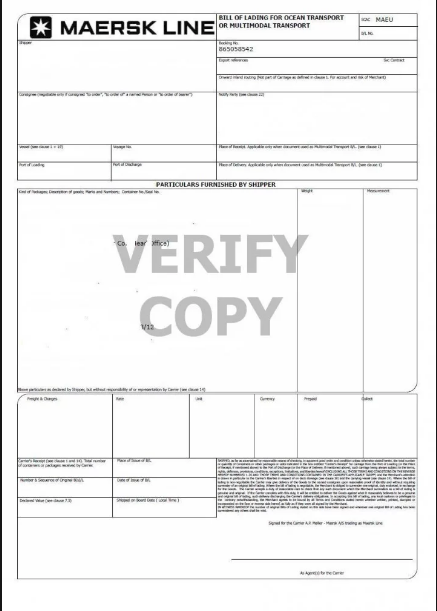

Bill of Lading

It is only provided by shipping agency for goods shipped by them. The purpose of creating a bill of lading is to deliver information about the shipper, consignee, carrying vessel, ports of loading and discharge, place of receipt and delivery, mode of payment and name of the carrier.

Bill of Exchange

It is used in the situation when an importer agrees to pay the exporter in future on a date on or before that is mutually agreed upon. A Bill of exchange is basically an important written document in wholesale trade wherein large amounts of money is involved. There are two kinds of classification— as a bill of exchange after date and bill of exchange after sight. Under which Bill of exchange after a date is when the due date for payment is counted from the date of the drawing. Whereas a bill of exchange after sight is when the due date for payment is counted from the date of acceptance of the bill.

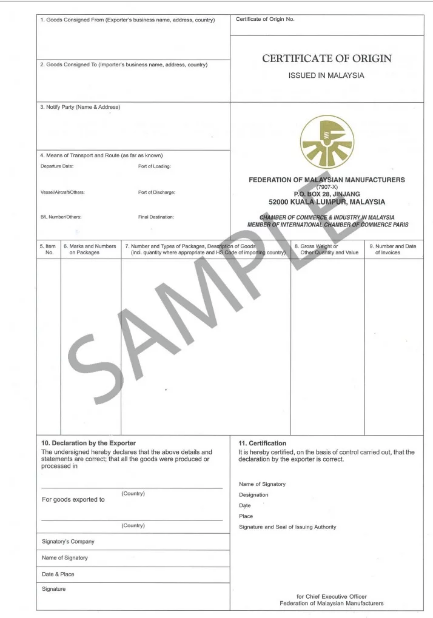

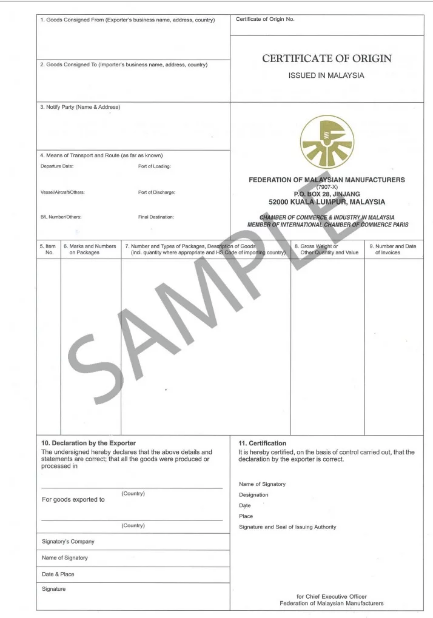

Certificate of Origin

It is usually requested by the Customs Authority while clearing Customs. A Certificate of Origin contains the name and address of the exporter, package number, details of the goods or shipping marks and quantity, and use to establish the origin of the product. It is issued by the Chamber of Commerce of the Exporter’s country.

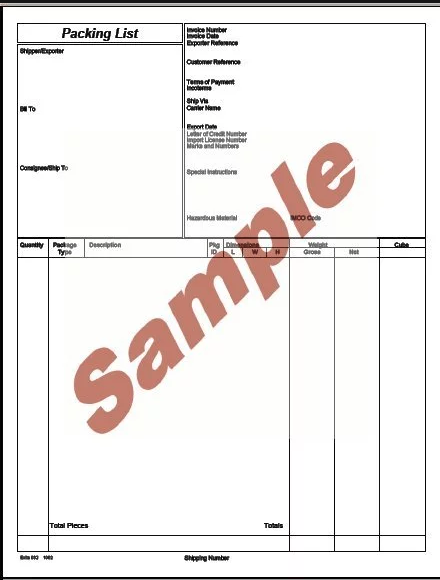

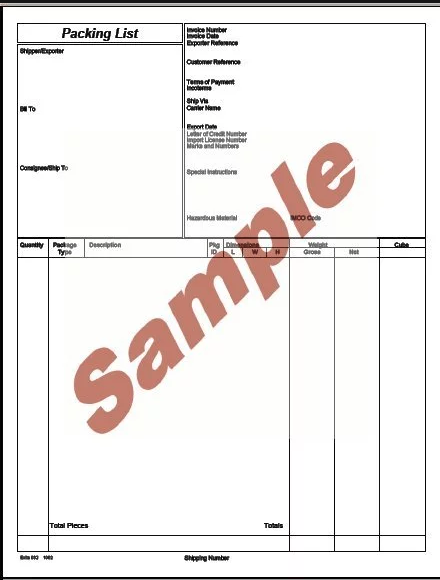

Packing List

It contains detailed information about the goods being shipped, quantity, weight and packing specifications. Besides, it is mandatory that a packing list must contain a description of the goods and have details regarding the shipping marks.

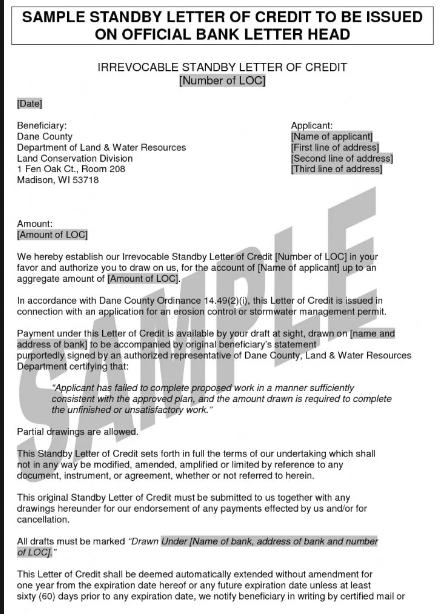

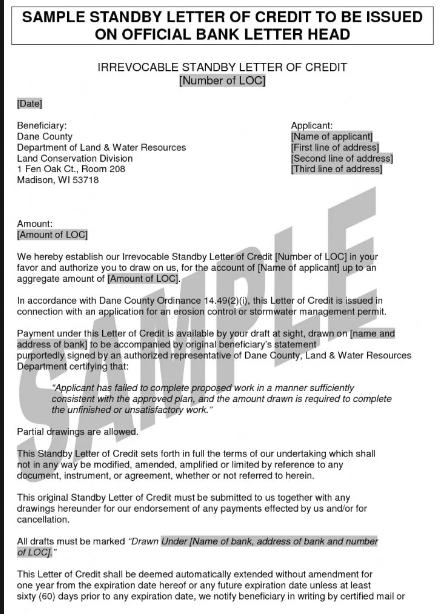

Letter of Credit

It is basically an arrangement wherein a Bank on the request of it customer agrees to make payment to a beneficiary on receipt of documents from beneficiary as per the terms stipulated in the Letter of Credit. The global use of LC makes it mandatory in domestic trade transactions also. Click here to know about

the advantages and disadvantages of Letter of credit

For more information about

IEC Code,

Steps involved in Processing on Export Order and

franchise partners you can visit our website:

LegalRaasta. Here, our business advisors will guide you regarding the compliances of the export and import procedures. So, apply today and call us at

8750008585 and feel free to send your query on Email:

contact@legalraasta.com

Related Articles:

Import Export code in India

The Custom Procedure to Export Precious Metals

Procedure fo shipping for Export of Plastic and Plastic Articles

For more information about IEC Code, Steps involved in Processing on Export Order and franchise partners you can visit our website: LegalRaasta. Here, our business advisors will guide you regarding the compliances of the export and import procedures. So, apply today and call us at 8750008585 and feel free to send your query on Email: contact@legalraasta.com

For more information about IEC Code, Steps involved in Processing on Export Order and franchise partners you can visit our website: LegalRaasta. Here, our business advisors will guide you regarding the compliances of the export and import procedures. So, apply today and call us at 8750008585 and feel free to send your query on Email: contact@legalraasta.com