ESIC Portal: Login, Online Procedure for ESI Registration & eligibility

Introduction

ESI Scheme is basically a self-finance comprehensive scheme which has been launched to safeguard the financial distress of the employees arising out of the events of sickness, disability or any kind of employment injuries that may lead to death. To protect the employees from such uncertainties, the ESIC (Employee's State Insurance Corporation) has been set up under the ESI Act 1948, which is responsible for the administration of the ESI scheme. In this article, we will discuss how to log in the ESIC portal and what are the services offered by it.ESIC Portal and the services offered

The ESIC portal provides a wide range of services in order to ensure hassle-free services to the employers and beneficiaries. Its services include ESI registration, online payments, information sharing, grievance redressal, and support to name a few. There are Bilingual information website i.e “www.esic.nic.in” and Service Website “www.esic.in” which being operated already.Who is eligible for ESI Registration?

As per the ESI Act, this ESI scheme is applicable in implemented areas and applies to all factories and establishments which are employing 10 or more employees. Those employees whose salary is Rs. 21000 will be eligible to avail the benefits of the ESI but employees who are earning above Rs. 21000 will lose their ESI membership. There are several benefits in terms of cash and non-cash for the insured person.

Following are its cash benefits:

- Sickness

- Maternity

- Disablement

- Funeral expenses

- Medical bonus etc

Following are its Non-cash benefits:

- Medical care for themselves

- Medical care for Family

Process for ESI

Employers who are coverable as per the ESI Act must register online within 15 days at www.esic.in. As soon as they will be registered successfully, they will get 17 digits of unique employer code. There is no need for fresh registration if the employer is already having this 17-digit code. Rather, he/she can get sub-codes generated in respect of its branches. The sub-codes should be generated only in respect of branches located outside the jurisdiction of the regional or sub-regional office in which the main office is located. This ESIC portal is very user-friendly that has covered all compliances required under the Act. After the ESI registration, the employer can proceed with the given services under the Act without the need of visiting the ESI offices even once:- Registration of employers and employees

- Issuance of Temporary Identification Card (TIC)

- ESI contribution through online payment by the employers or online generation of challan for contribution payment

- Payment of cash benefits at Branch offices

- Facilitation of Medical Care at hospitals

- Lodge grievance online and get redressal

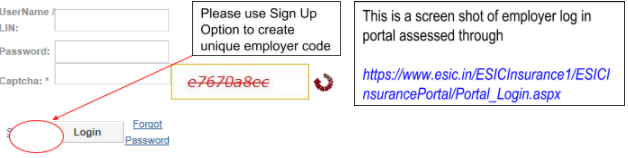

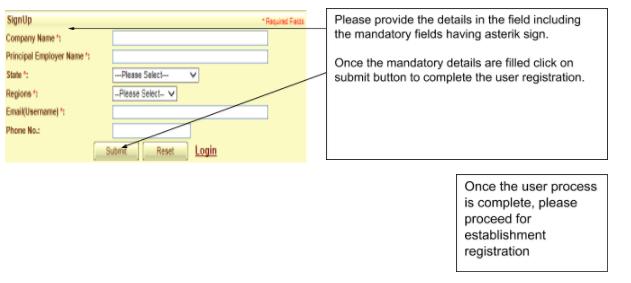

Procedure to ESIC portal Login

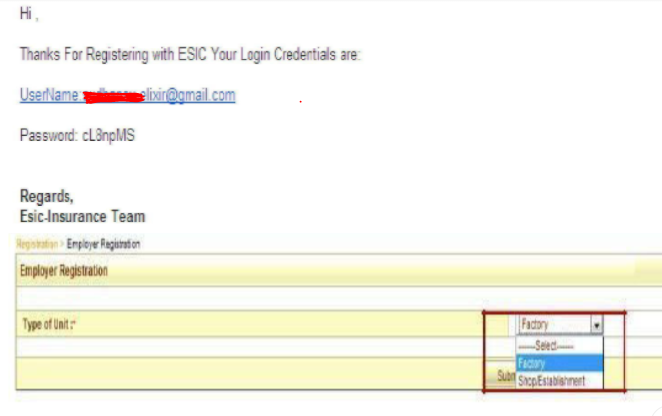

Once the employer will get the "employer code" then you can log in to the employer portal and register its employees as soon as they are being employed. In the beginning, the employee registration needs to be done by himself under the ESI scheme by declaring his personal details such as details of his family members, residential areas of each and every family members including himself, and the dispensary in which they want to avail the medical treatment etc. After the procedure of registration, the employee will get the insurance number which is generally a unique and valid number throughout the life of the employee agnostic of job changes. In the end, a Temporary Identity Card (TIC) will be generated. Its validity is for a period of three months from the date of registration within which the employee has to enroll for the Pehchan Card. You can see the above process of online ESI registration by the help of pictures: As soon as you click on sign off, the below screen will appear:

As soon as you click on sign off, the below screen will appear:

Provide the details are properly, then the below confirmation screen will prop up:

Provide the details are properly, then the below confirmation screen will prop up:

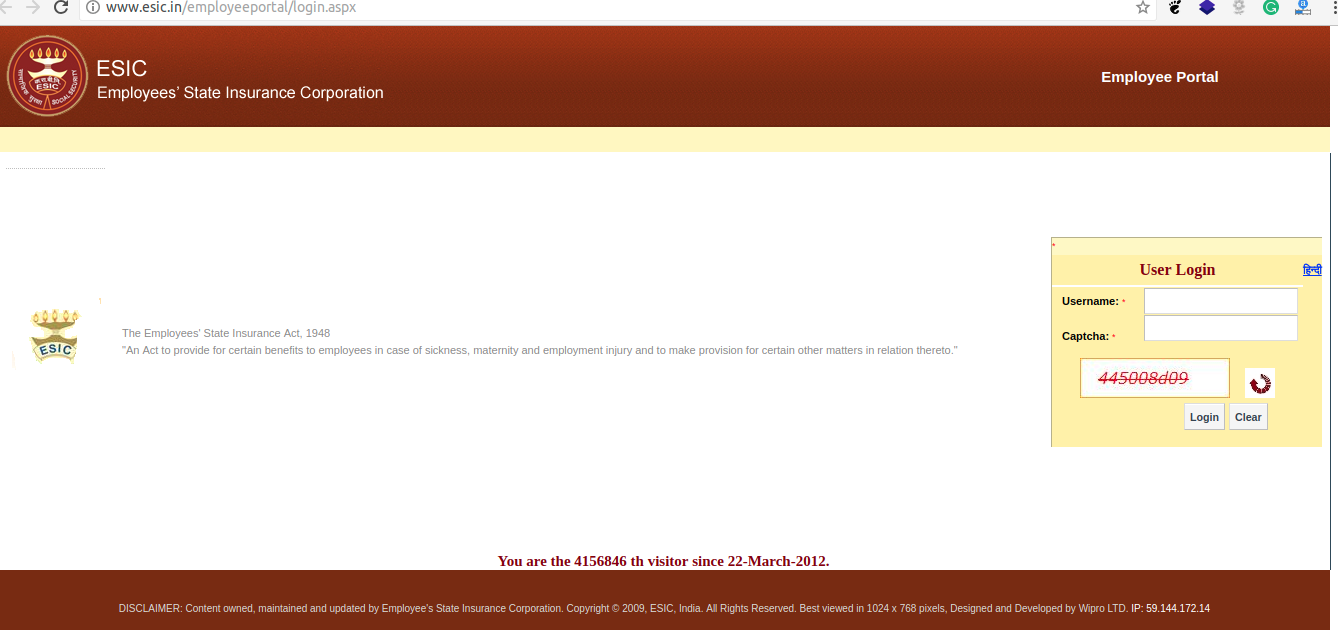

This ESI scheme is not only contributed by the employee but by both the employer and the employee. There is a fixed rate contributed by the employer i.e 4.75% and the employee will contribute 1.75% of his salary. Employees who are earning less than Rs. 137 as a daily average wage are exempted from the payment of their share of contribution. Once the employer is done with the registration procedure, the insured person (IP) can log in to the IP portal (www.esic.in/employee portal/login.aspx) as shown below with their insurance number as the user id and ascertain the details of contribution paid on their behalf, their entitlements to various benefits prescribed by the ESIC etc.

This ESI scheme is not only contributed by the employee but by both the employer and the employee. There is a fixed rate contributed by the employer i.e 4.75% and the employee will contribute 1.75% of his salary. Employees who are earning less than Rs. 137 as a daily average wage are exempted from the payment of their share of contribution. Once the employer is done with the registration procedure, the insured person (IP) can log in to the IP portal (www.esic.in/employee portal/login.aspx) as shown below with their insurance number as the user id and ascertain the details of contribution paid on their behalf, their entitlements to various benefits prescribed by the ESIC etc.

For further more information regarding ESI Registration, EPF registration, the procedure for the EPF registration or more, you can visit our website: LegalRaasta and also follow our blog. Our experts are available for you to solve your business related problems and can suggest you the best advice. So, hurry up! Give us a call at 8750008585 and feel free to send your on Email: [email protected]

For further more information regarding ESI Registration, EPF registration, the procedure for the EPF registration or more, you can visit our website: LegalRaasta and also follow our blog. Our experts are available for you to solve your business related problems and can suggest you the best advice. So, hurry up! Give us a call at 8750008585 and feel free to send your on Email: [email protected]

Related Articles: How to check your PF account balance and statements How to check the online PF claim status? National Pension Scheme | How to join NPS and what are the documents required |