8 things one should know about epfo

EPFO is named as Employees' Provident Fund Organisation. The EPFO has been involved in assisting the statutory body and Central Board of Trustee formed by Miscellaneous Provisions Act including the EPF. They are following the regulatory control of the Ministry of Labour and Employment, Government of India. The EPFO functions the double role of being the executive and supervising the implementation of the Act. Also, EPFO is a service provider for the protected pensioners which involves both employers and employees that is EPF members. EPFO has been taking various actions to interpret the procedure of EPF account including the

EPF balance both for employees and employer by selecting IT-enabled techniques and tools.

In the whole paragraph, one will observe the role of EPFO in upgrading the social security system for the employers and the employees in India and how they go about it.

Lets us explore the things one should know about the EPFO

EPFO was founded on 4 March 1952.EPFO assists the Central Board in determining necessary contributory schemes a pension, Insurance and Provident Fund Scheme for the workforce involved in the regulated sector in India. It also executes Bilateral Social Security Agreements with different countries on a correlative basis. The schemes comprise Indian workers and International workers which have bilateral agreements signed.

The name for Employees Provident Fund Organization of India the in the Hindi Language is seen in the picture below.

-

The purpose of creating EPFO

For rendering a bright future to the industrial workers after their retirement or for their dependents, in the event of their premature death, involved the attention of the Central Government for a long time. The first Provident Fund Act passed in 1925 for regulating the provident funds of some private concerns was limited in scope. Looking to these concern many schemes and act introduced to avoid the mishappening. The success of this Scheme made in1948 led to the demand for its expansion to other industries. After this, at the end of 1951, the employees' provident fund ordinance was taken into the account and in 1952 it was replaced by the Employees' Provident Funds Apracticalityct. For managing all the schemes and act by the goverment and regulatory body they designed EPFO.

-

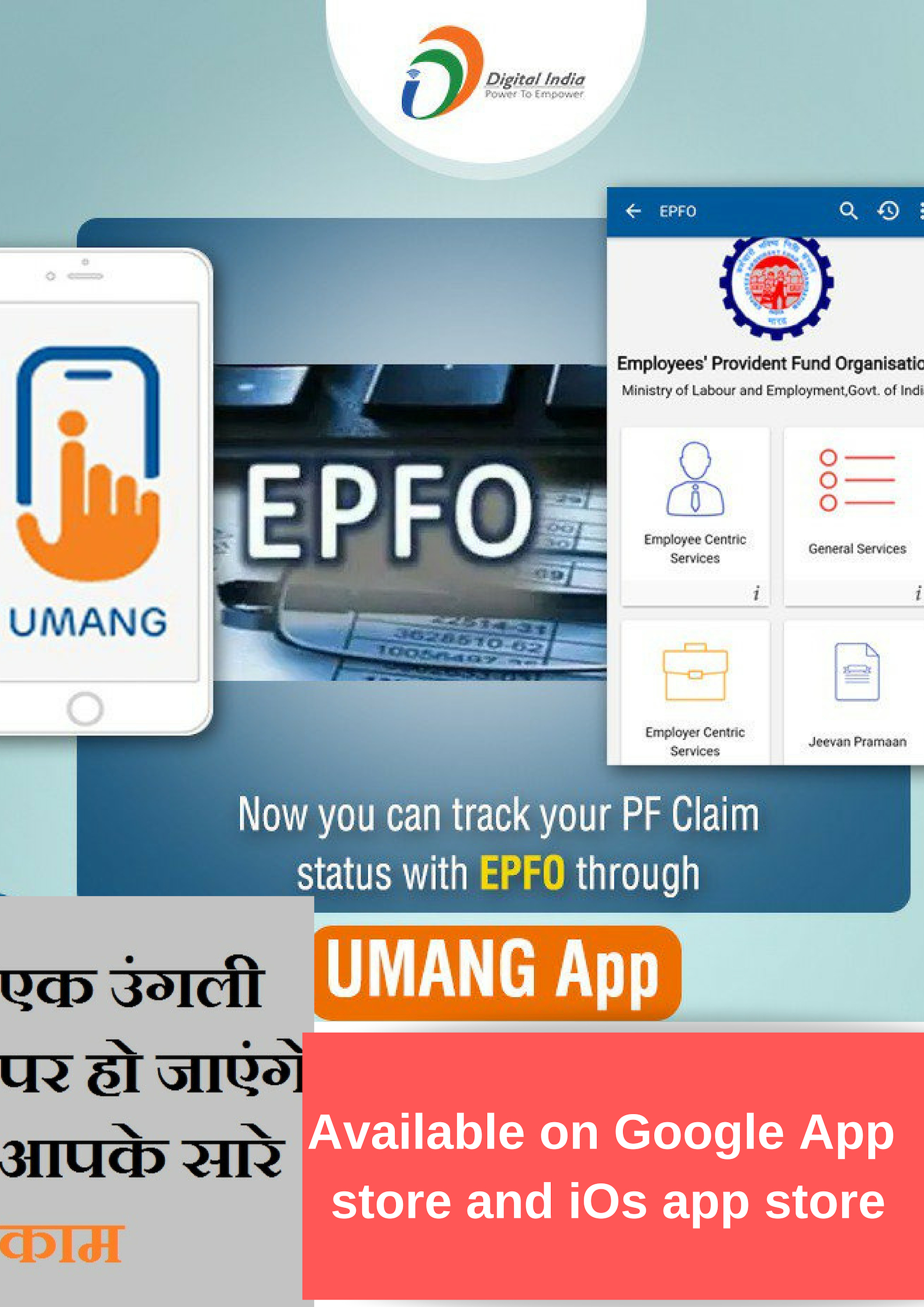

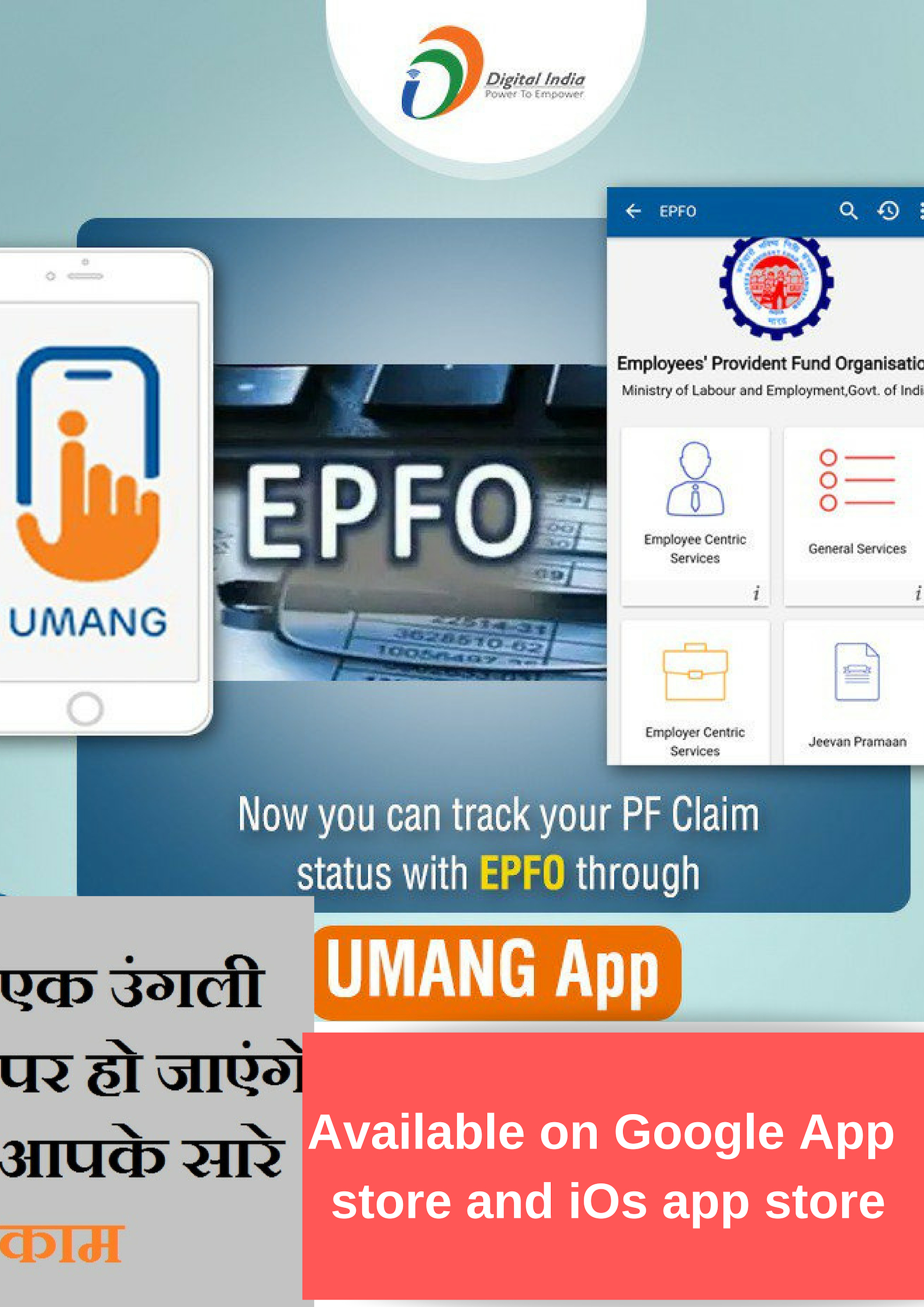

The Easy and simple way to cater EPFO services

EPFO services are presently accessible on the UMANG mobile app. You can easily cater to all the services presented by EPFO and you can also enquire about EPF. For the

EPF Registration, you can cater to the services provided by us at legalraasta. The UMANG APP can be downloaded by giving a missed call 9718397183. The UMANG app can also be downloaded fro from the play/app stores.

Here is a link to download UMANG APP :

https://play.google.com/store/apps/details?id=in.gov.umang.negd.g2c&hl=en_IN

-

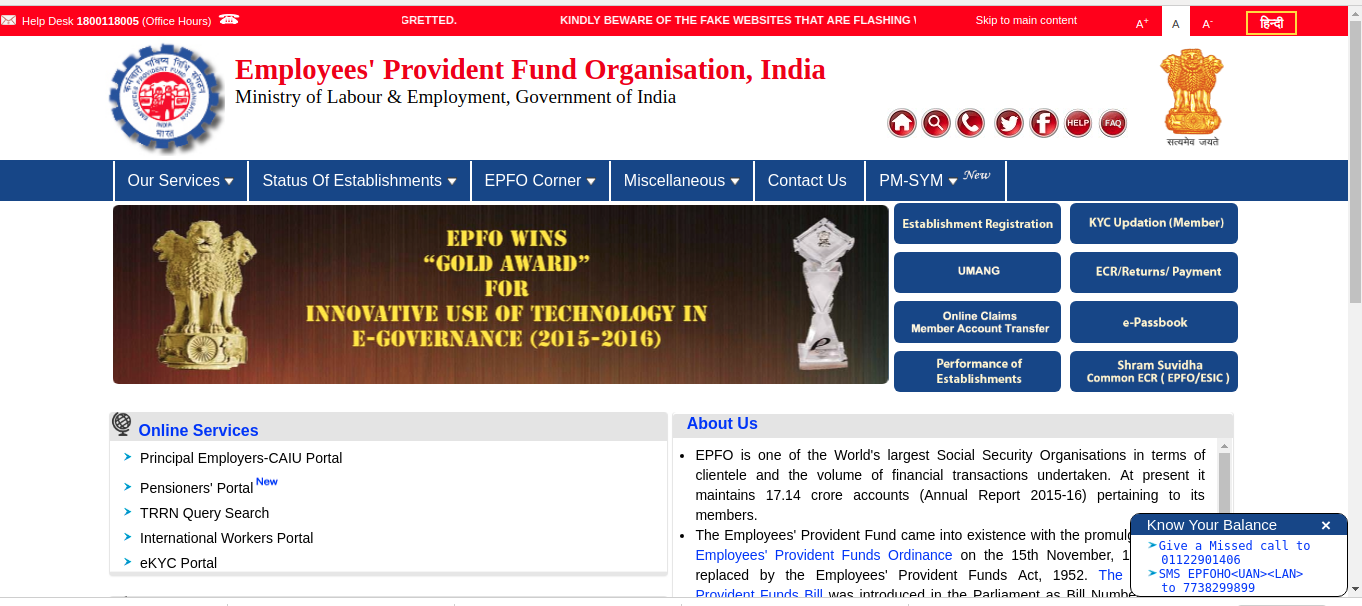

The EPFO has Portal Services

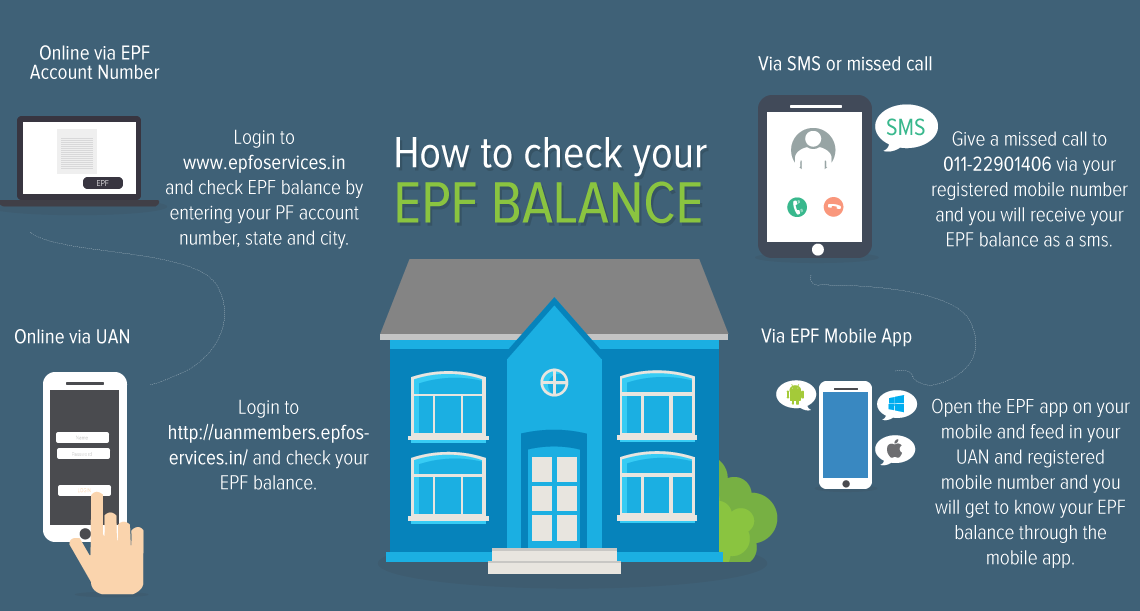

practicalityPeople who are part of the EPFO can review their

EPF balance and statements by ministering the official website of the Employees’ Provident Fund Organization. The government has launched a website portal for the employees to review all about EPFO. You can cater to all services linked with EPFO, PF and EPF.

Visit the official

EPFO Website by the goverment of India.

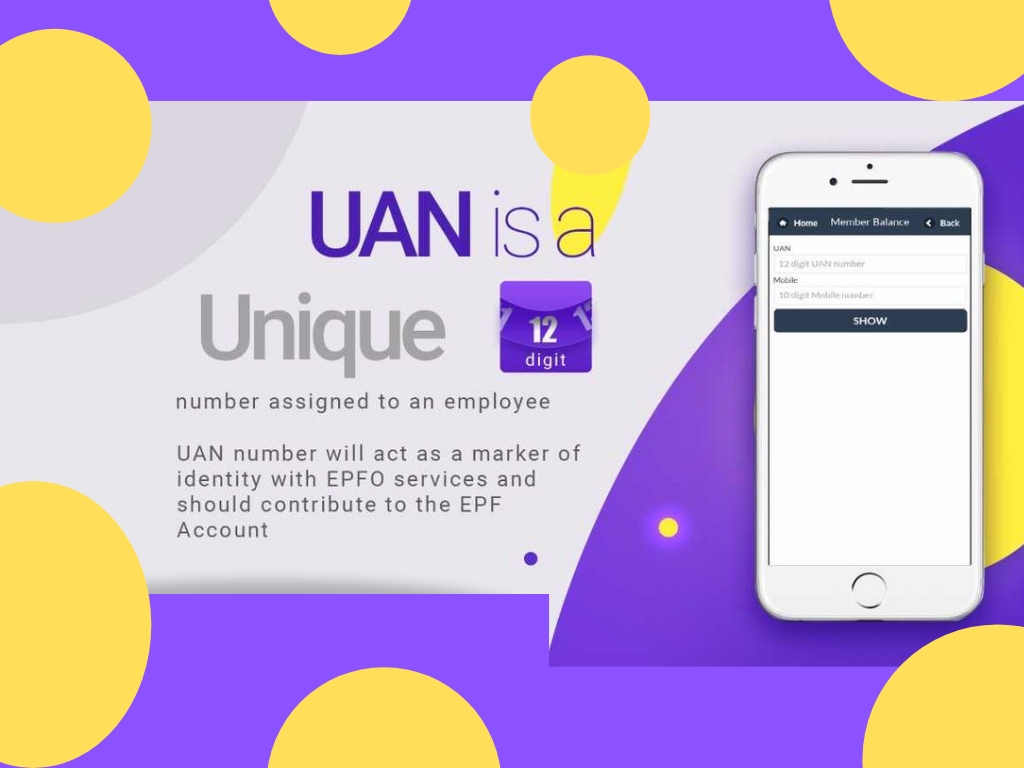

Employee Provident Fund Organization founded UAN(Universal Account Number) which functions as a sunshade for the various Member Ids assigned to an individual by diverse employers. Employees are obligated to initiate their UAN at UAN portal in series to avail ample range of online services given by EPFO. The UAN programme was begun in October 2014 as a section of Pandit Deen Dayal Upadhyay Shramev Jayate Karyakaram and

UAN Registration is a necessity for EPF. It is possibly the most outstanding step taken by EPFO. UAN is a unique twelve-digit numeral allotted to an employee by EPFO. One will receive an advantage activating UAN at

Unified Portal from mobile number. It allows connecting of various EPF Accounts given to a single member. UAN offers a variety of services like updated PF passbook including every transfer-in details, UAN card and ease to link past members’ ID with present ID.

-

EPFO governs offices to pay a greater amount of pension to eligible members of EPF

The EPFO has begun to push their offices to provide a greater amount of pension to those members of EPF who are eligible for it based on a landmark review by the Supreme Court. The apex court's decision had guided the EPFO to review the pension on raised wages of the applicants under EPS. This is good news for the EPS subscribers.

-

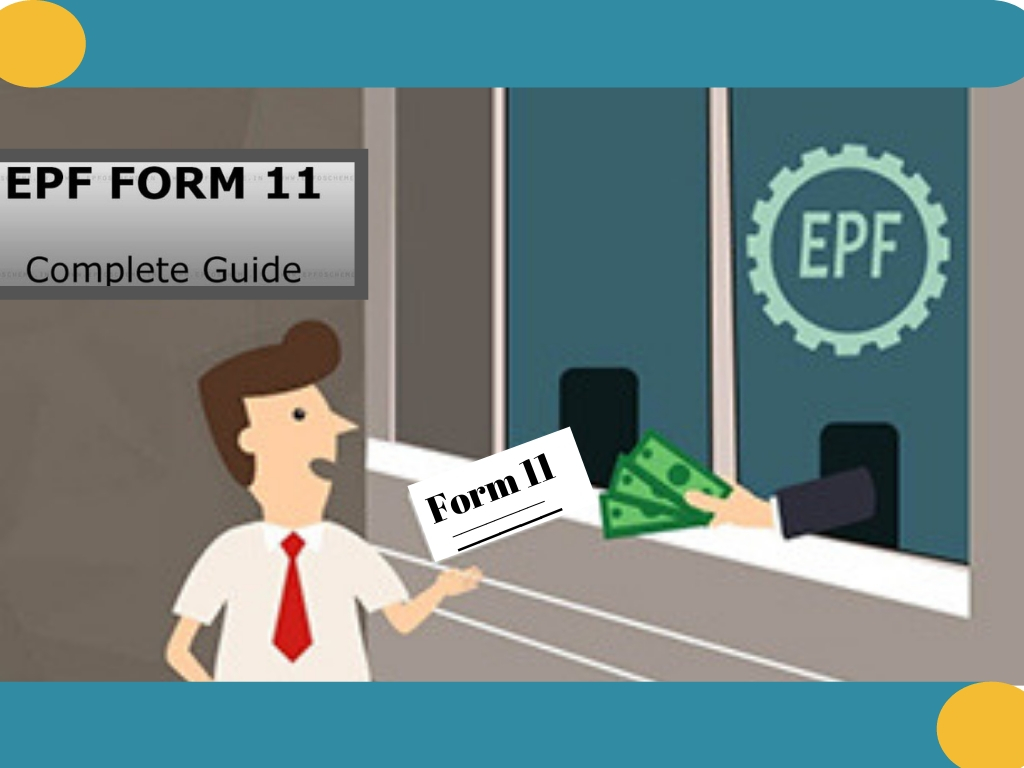

EPFO launches a common form for various kinds of withdrawal

By the grace of EPFO, the subscribers of retirement fund body can instantly withdraw money from their provident fund account by applying one standard form and will not be asked to file certificates. Digital India has grown with Aadhaar Cards linking and it can be presented as proof without the attestation of employers.

The EPFO has a purpose is to enlarge its scope and position publicly and execute old age income security programs with a plan to reposition itself as a leading Social Security Organisation. The EPFO gives futuristic services which keep on developing its elements of provident funds, pensions and retirements.

For more details connected with

EPF Registration and

ESI Regisration, you can visit our website services

LegalRaasta .Our expert team will guide you in every part connected with EPF and ESI. You can download our app which are easy to access in android mobiles

LegalRaasta APP.Even you can give us a call at

8750008585 and feel free to send your query on Email:

contact@legalraasta.com

Related Article

Procedure to Register for Employee Provident Fund

Tax Treatment of Provident Fund (EPF)

How to check your PF Account Balance and Statements