Highest tax benefits with ELSS Funds

What is ELSS?

ELSS (Equity-linked savings scheme) is basically a type of diversified equity mutual fund (MF), which is qualified for tax exemption under

section 80C of the Income Tax Act. Returns from an ELSS fund reflect returns from the equity markets since it is an equity fund.

Why should we invest in an ELSS?

The

funds of ELSS are one of the best avenues to save tax under section 80C. Because along with the

Tax savings, the investor also gets the potential upside and growth of investing in the Equity Markets. Besides, No tax is levied on the Long -term capital gains and dividends from these funds.

In addition, compared to other tax saving options (ULIP/Insurance, Fixed Deposit etc), ELSS has the shortest lock-in period of three years.

Growth or Dividend Option

Both the options are there in case of ELSS funds i.e Dividend as well as Growth options so that the investors in a dividend scheme, can get dividend income, whenever a dividend is declared by the fund, even during the lock-in period.

Read more: Taxability on dividend income

For Instance:

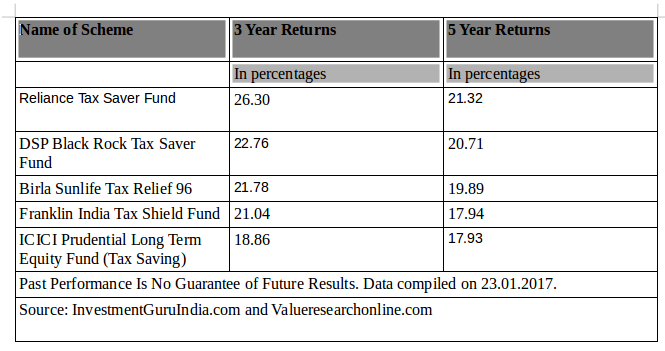

As we know, Reliance Tax Saver Fund has generated cash flow through dividends and the scheme has given a dividend of Rs. 13.86 per unit on the face value of Rs. 10 per unit, since inception. Moreover, this scheme has given 16 dividends in the last 15 quarters.

Usually, these dividends come from the funds’ NAV (net asset value). This option of Dividend could be useful to investors who need regular income whereas Growth option would be useful to investors who are seeking long term appreciation and wealth creation.

Under Growth option, investors can withdraw a lump sum amount on the expiry of 3 years lock-in.

How to select the ELSS Funds?

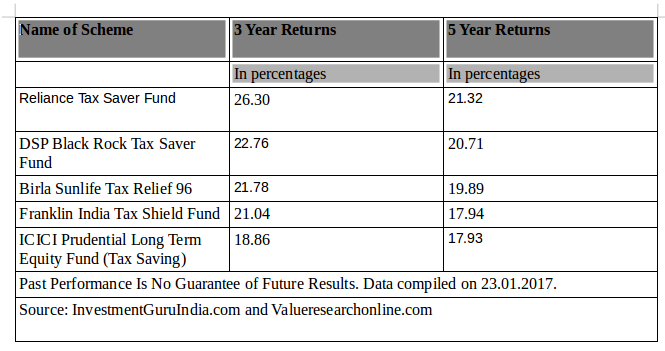

It often happens that investors ignore the research process before making investments. Do not make such a mistake. Do proper research before investing and go through the KIM, SID and offer document as all investments are subjected to market and credit risk. While doing research, an investor should avoid judging schemes on the basis of short-term performance and it is advisable to invest in schemes that have long term performance track record of at least 3 to 5 years. Remember, longer the track record available, better for investors to study the same.

As the ELSS has got 3 years of Lock In, it will be better if an investor keeps on investing in the fund for the long run. Hence, there is no need to pull the money out if the scheme is performing well. Apart from this, the ELSS invests in equity, you should be prepared to stay invested for at least five to seven years.

In a nutshell, one can do an analysis of other

mutual fund schemes and basis which with the help of their financial advisor they can choose the funds for investment.

Read more:

Tax Saving on Mutual Funds

Following are some of the

Mutual Fund Distributor prevailing in the market with their performance:

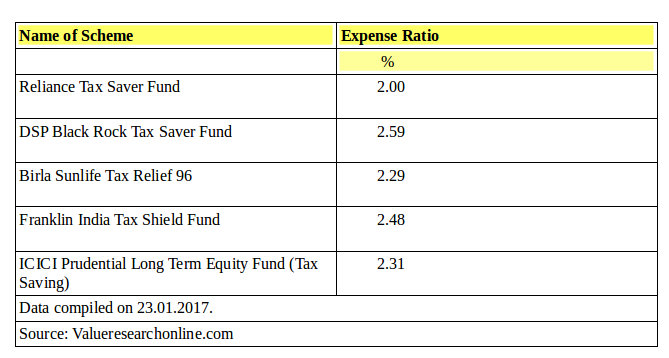

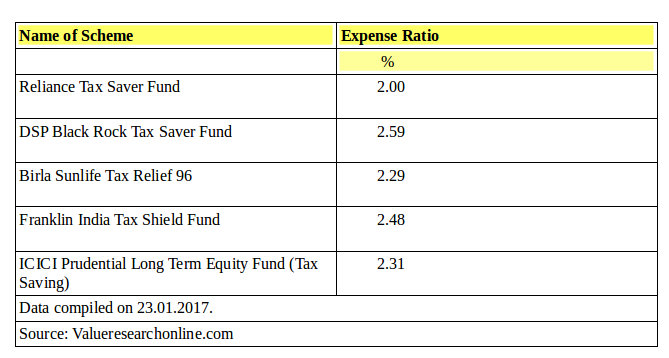

Expense Ratio

Expense ratio reveals how much you pay a fund in percentage term every year to manage your money. But on the contrary, the Securities & Exchange Board of India has stipulated a limit that a fund can be charged. So, it becomes important in long run to go through the Expense ratio that is charged by funds as it could affect the returns.

At last, investors are suggested to consult their financial advisor before investing so that they can get a complete picture of the scheme. But your financial advisor should have completed all the certifications as prescribed under SEBI and AMFI. You can take advice from our experts also at

LegalRaasta. We provide all kind of Legal services related to business activities such as

Company incorporation,

Income tax return online,

mutual fund agent etc So, give us a call at

8750008585 and feel free to send your query on Email:

contact@legalraasta.com

Related Articles:

Tax benefits on investing in mutual funds

How to Get Your Pending Income Tax Refund: Tax Ombudsman

Professional tax: meaning and Compliances

At last, investors are suggested to consult their financial advisor before investing so that they can get a complete picture of the scheme. But your financial advisor should have completed all the certifications as prescribed under SEBI and AMFI. You can take advice from our experts also at LegalRaasta. We provide all kind of Legal services related to business activities such as Company incorporation, Income tax return online, mutual fund agent etc So, give us a call at 8750008585 and feel free to send your query on Email: contact@legalraasta.com

At last, investors are suggested to consult their financial advisor before investing so that they can get a complete picture of the scheme. But your financial advisor should have completed all the certifications as prescribed under SEBI and AMFI. You can take advice from our experts also at LegalRaasta. We provide all kind of Legal services related to business activities such as Company incorporation, Income tax return online, mutual fund agent etc So, give us a call at 8750008585 and feel free to send your query on Email: contact@legalraasta.com