Credit Co-operative society : Registration and Benefits

Introduction to credit cooperative society registration

Credit cooperative society registration is basically registering credit cooperative society according to the legal documentation and with a group of people who have the same motive. Society Registration is very important for credit co-operative society The credit cooperative society is one of the types of cooperative society and is a part of a multi-state co-operative society. For download a form 1 of a multi-state co-operative society visit to the official website of MSCS. A credit co-operative society is a credit society that is a member-owned financial cooperative and is controlled by its member. The motive of promoting the economy and society is key for credit cooperative society registration is providing credits at a reasonable price and giving financial services to its members. The credit cooperative society registration includes fewer documents compared to others. Also, these societies do provide loans to their members for economic and social growth. You have a benefit from these loan services from credit cooperative society registration. Legalized societies are the 1st preference of everyone.What does a credit cooperative society do?

After the credit cooperative society registration, it can do work for the welfare of the society :- They are formed to give financial support to members.

- Their chief role is to conclusively preserve the rights of producers and consumers (Rural people).

- Acquires deposits from members.

- They tend to eliminate additional profits of middlemen in business and trade.

- Provides loans to the member at reasonable rates of interest. ( Home loan, personal loan, vehicle loan etc.)

Must read: How To Finance A New Home

Types of credit cooperative society

How to classify the credit cooperative society?

[caption id="attachment_20164" align="alignnone" width="1024"] The three classifications for credit cooperative society registration[/caption]

The three classifications for credit cooperative society registration[/caption]

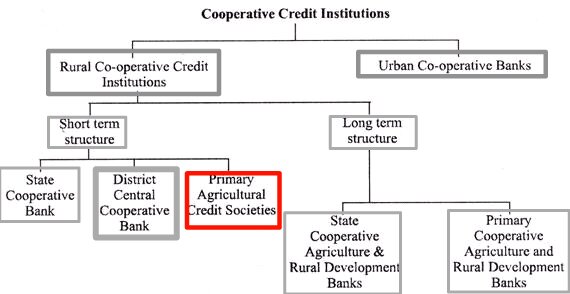

Under a three-tier structure, you can observe a classification of a credit cooperative society :

-

Primary Credit Cooperative Society

-

Central Credit Cooperative Society Banks

-

State credit Co-operative society Banks

How to Register a Credit Co-operative Society with required documents?

The way of credit cooperative society registration :

The way of credit cooperative society registration :

- Certificate from the bank declaring the credit balance is in support of the respective credit co-operative society.

- Every state must have a minimum of 50 members.

- The board members should be at least 7 and maximum 21.

- The promoter members name and list.

- No Objection Certificate (NOC) of the intensive inquiry letter.

- 4 copies of Model bye-law.

- All the details and copy of the pre-registration meeting judgement. That includes the capital, members, the board, and the operation etc.

- The recommended name by the members of your credit cooperative society.

- Details of head office address to be registered.

- A document in writing comprising of detailed plan format that how credit-cooperative society is useful for the economic and social development of its member and community.

What is the benefit of Credit Cooperative Society Registration?

The credit co-operative societies have a key role in spreading a sense of self-sufficiency. They think about the economic welfare amongst rural section which is a less developed section of the society. They have a great feature of balancing the business units stability with the belief of serving the members with the honest motive of achieving financial security. Society registration is very important and mandatory for its formation.- The Credit Co-Operative Society is formation is easy. 10 or more adults can connect mutually to build society. Also, credit cooperative society registration is easy and comfortable. The best part is not too many legal formalities one have to keep for its formation.

- There is no membership obstacle unless especially denied. The membership of such a society is free for everyone. There is no barrier on the basis of gender, creed, colour, caste or religion. Any person can enter into society anytime and become its member.

- The liability is limited in the formation of a credit cooperative society. The liability of a member is restricted to the extent of contributed capital by him/her to society. This is good for the members as in case the society faces any loss, the members do not have to think about losing the personal assets and property.

- The LLP Registration should also be taken into the account.

- Credit co-operative society - Completely govern by elected members among themselves. Everyone has the same rights in all manners. They can take part actively in the development or revisions of the society’s policies. This proves that all members are equally important and the credit co-operative society is democratic management.

How is the credit cooperative society registration under a central government safe for investments?

The following points will let you know that the credit cooperative society registration under a central government safe for investments :- The society was established in the 2002 act. A credit society is a group of corporate. It supports people collectively by merging the resources, fund to the weaker sectors of the economy such as rural area people.

- Its chief purpose is to give credit facility to various states. It has a financial general formation which works mutually. For the progress of businesspeople.

- It is Registered under the central government. The by-laws should present for the economic and social progress of the cooperative society.

- The advertisements, reports, plans are circulated by the Central bank to state cooperative banks.

How can one verify if a co-operative credit society is registered or not?

There are various Credit Co-Operative Societies moreover all of them are registered. But we can analyze it in different situations.- If a credit cooperative society is running in one state, then the state government see the concerns of it. It designates a Registrar for registration.

- If the credit cooperative society is running in multiple states the Ministry of agricultural see the matters. For example, Adarsh Credit Cooperative Society. It is a multi-state credit cooperative society registered with the Ministry of Agriculture.

Which are the Big credit cooperative society in India?

There are several big Big credit cooperative society in India out of them some societies are :- Sahara Credit Society

- Adarsh Credit Society

- Navjivan co-op Society

- Prithvi Credit Co-operative Society

- Sanjivani Credit Society

- Arth Multistate credit Society

- Peers co-operative Society

- Lokhit Bharti Credit Co-op. Society

- Arogya Dhan Varsha Credit Society

- Kheteshwer Credit co-op. Society

Conclusion

Related articles Registrar of Companies India