Everything you need to know about the Company Incorporation Procedure in India

Company Incorporation Procedure

Got a great startup idea? Everybody seems to have one these days and nothing should stop you from pursuing your dream as well. But before you can start with any operations, you have to legally register as a business under the government rules so as to avoid any hiccups in executing your idea. So with this comprehensive guide, we wish to help you get acquainted with the company incorporation procedure specifically tailored to India. What's the procedure? What's are the documents required? What are the governing authorities? Let's look at this and more and help you get a head start with starting your company.

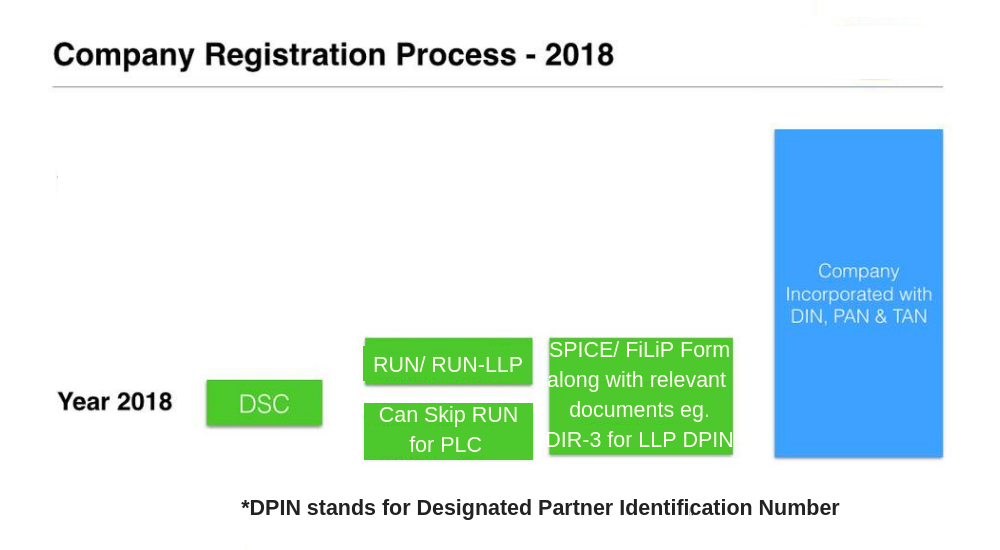

In India, the Ministry of Corporate Affairs (MCA) looks over the company incorporation procedure and legalities related to it. Most companies in India like Private Limited Companies, Sole Proprietorships, Public Company, NBFC among others come under the jurisdiction of the Companies Act, 2013. An exception to this is Limited Liability Partnerships (LLPs). These come under the LLP Act, 2008. Because of this, many procedures for LLPs are different as compared to most companies. Lets take a brief look at the graphical company incorporation procedure.

[caption id="attachment_15351" align="alignnone" width="1000"] Company Incorporation Procedure[/caption]

Company Incorporation Procedure[/caption]

Company Incorporation Procedure: Steps

At a glance, company incorporation procedure might seem daunting. However, it is a very simple procedure if you follow it step for step. Lets look at the steps and how you can go about forming your company and getting started on your idea.-

Deciding the Proper Business Structure.

This is a big step when you get started with the procedure to incorporate your company. This basically decides the direction your company will take, whether you're open to investments, whether you want to restrict liability, whether you want to go solo it all depends on what you think will be best for your startup. Based on the decision you take, you can form the following types of companies in India.-

Private Limited Company

Minimum number of Shareholders: 2 Limited Liability: In case the company is incurring losses, members only have to pay as much as their shares value. Perpetual Succession: Company keeps on existing even after death or exit of directors Authorized Capital: Minimum Rs. 1 lakh. Read more about Authorized Capital Shareholding: Shareholding in Private Limited Company is closed, they cannot attract investments or trade shares to the public. Exemptions: Private Limited Companies are entitled to many compliance and operational exemptions. Read: Exemptions Private Limited Companies. -

Limited Liability Partnership

Minimum Number of Shareholders: 2 Limited Liability: Similar to Private Limited Limited Companies Lenient Taxation Scheme: LLPs are taxed as a Partnership firm Organizational Flexibility Shareholding: LLPs have open shareholding which means they can attract investments as well as trade shares to the public Perpetual Succession: Similar to Private Limited Company Authorized Capital: Minimum Rs. 1 lakh, Similar to Privat Limited Company -

Sole Proprietorship

Most flexible business structure Solo Traders Total Control over decision making Easy Winding up Procedure Marginal Tax Rate -

Public Company

Limited Liability Stakeholder Involvement Can attract investments, as well as, the shareholding is open Great for growth standpoint can offer securities such as debt or equity -

One Person Company

One member/ One Shareholder It is treated as a Private Limited Company No need to hold the Annual General Meeting (AGM) Have to appoint a nominee for succession -

NBFC (Private Limited Company)

Financial Organisation Loans to the public Investment Companies, Loan companies providing loans in a convenient fashion Governed by RBI and MCA both

You can go ahead and read the comprehensive guide to the Business Structures in India for more information. If you're still confused about the business structure, Go ahead and read some of these articles for further clarity

-

-

Directors' Digital Signature Certificate (DSC)

A Digital Signature Certificate or DSC for short is the physical signature in a digital format used for online validation and filing tax returns and other legalities. To form a company, first, you have to appoint a Director. Check Out: Appointment of Directors as per the Companies Act and the various Types of Directors. Once you have appointed your directors, you have to obtain the digital signatures. -

File for Name Approval / Check Name Availability

A very important aspect of your company is deciding a name and getting the name approval. While you might have an idea for a very funky, innovative name, someone in your industry might already have registered the same name for their company. Thus, it is pivotal to perform a company name search in order to avoid any conflicts. It could also lead to a lot of legal troubles as man times these companies have done a Trademark Registration on the company name. Therefore, check name availability before registering a name. If you're sure no one has the name you're proposing use the RUN (Reserve Unique Name) e-form to file for name approval. Filing for name approval can be done via the SPICe forms (INC-32), [Simple Form for Incorporating a Company] however, it is advisable to use the RUN service and provide the SRN in the SPICe forms. For LLPs, the separate e-form RUN-LLP has been released by the MCA. You can head over to the MCA portal to start your filing for name approval if you get confused on what to do, give us a call +91-8750008585 so that we can speed up the company registration procedure for you. -

Incorporation Procedure

The two basic things i.e. Name Approval and Digital Signature Certificates (DSC) will empower business owners to go for the next step i.e. Incorporation filing. The Incorporation filing for most companies is similar i.e Companies under the Companies Act, 2013. For these companies, the SPICe forms are used. The SPICe forms are facilitating One-Day Company Incorporation for companies under the Companies Act, 2013. The SPICe forms have integrated the following company registration procedures under 1 form.- Obtaining DIN (Director Identification Number )

- Name Reservation

- Incorporation

- PAN Application [Section 49 A of the SPICe form (INC-32])

- TAN Number [Section 49B of the SPICe form]

How long does the company incorporation procedure take?

Roughly about 7-8 days. While there is no guarantee or fixed time frame for how long it will take to form a company in India. We can roughly estimate in-total how much time the entire procedure will take. Though the government claims to have put in place, a simplified procedure to incorporate a company in one day, however, that is just the processing time of your SPICe form. There are documentation, as well as, preparations a business owner has to be ready with before they even file for incorporation. Let's break down the Time required to incorporate a company in India from scratch.- Preparing the Documents. [ 2-3 Days]

- Signing the Documents [1 Day]

- Processing DSC [2-3 Days]

- RUN/ RUN-LLP form [1-2 days]

- Incorporation Processing[SPICe forms or FiLLiP forms] [1 Day]

Documentation for Company Incorporation Procedure

In addition to the filing formalities, the Directors/ owners of the business have to produce a comprehensive list of documentation in order to successfully complete the company incorporation procedure. Let's take a look at the list.Indian Resident Directors

- PAN Card. Head on over to PAN Card Registration if you still have to acquire a PAN Card.

- Address Proof

Address proof should contain the name of the director as stated in the PAN Card. Any of the following documents qualify as an address proof.

- Aadhar Card

- Electricity Bill

- Driving License

- Ration Card

- Telephone bill

- Residential Proof (To verify the current address of the director). If Residential proof and address proof are same then no requirement.

Foreign Directors

For foreign directors, all documents submitted should be no older than a year in their validity. Following is the list of documents.- Passport

- Address Proof. The following qualify as Address proof for foreign nationals.

-

- Driving License

- Residence Card

- Bank Statement

- A government-issued form of identification containing the address

-

- Residential Proof: In addition to the address proof the foreign national directors should also submit a proof of current residence in the country.

Registered Office Address

The Ministry of Corporate Affairs has mandated the maintenance of a registered office premise for newly registered companies. In order to verify the registered office address of the company following compliances have to be met by business owners.- The registered document of title of the premises of the registered office

- The notarized copy of the lease/rent agreement.

- NOC (No Objection Certificate ) from the landlord

- Proof of any utilities of services in the registered office such as telephone, gas electricity

Shareholder Information (Individuals)

All the shareholders of the company have to subscribe themselves with their registered address proof and other details to the Memorandum of Association (MoA) and Articles of Association (AoA). The MoA and the AoA put together to contribute to what is called the constitution of the company. Constitution details the objectives and business activities of a company.Shareholder Information (Corporate Bodies)

In case the shareholder happens to be a corporate body for eg a company or an LLP then the body corporate must produce the certificate of incorporation along with a resolution of passed by the corporate body that they are subscribing to the shares of the company. The corporate body also has to produce documents like INC-9, their own MoA and AoA and the promoters of the organization should notarize said documents.Company Incorporation Procedure Fees

So there is one burning question every prospective business owner will have after going through the procedure for company incorporation i.e. What is the fees for starting your company? Let me tell you that the government fees for incorporating a company is ZERO. That's right! No fees for incorporation will be required to be paid if you go via the government's MCA portal.

However, sometimes it can be a bit confusing procedure and you could easily get lost on the website. Consider taking professional help with the expert help of CA/CS experts at LegalRaasta, where we help simplify your legal journey. Get started with cost-effective packages swift and streamlined company incorporation procedures. After Incorporation you also might need services like GST registration, GST Returns filing as well as Trademark registration your company. Call +91-8750008585 or you can fill up the form on your right by selecting the "company registration" service and providing us with your details. All the best for your venture!