LegalRaasta is an online portal for simplifying legal compliances for Individuals as well as businesses. We help provide the quickest and most efficient legal registration for businesses like GST consultation, Food License, as well as, Company Formation with Trademark Filing. In addition to this, our services extend to efficient tax management such as GST returns, and Income Tax Returns ITR. Call +91-875-000-8585 with your requirements

Central Board of Indirect Taxes and Customs (CBIC) – GST Portal : Erstwhile CBEC

Introduction to CBEC (CBIC)

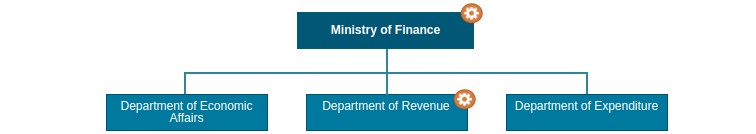

The Central Board of Excise and Customs (CBEC) now renamed as the Central Board of Indirect Taxes and Customs (CBIC) is the online portal and the department which deals with everything related to GST, Taxation, as well as, revenue. CBEC (now CBIC) is a part of the Department of Revenue under the Ministry of Finance, a part of the Government of India. The organization assumes the responsibility of formulating a policy with regards to levy and collection of Customs, Central Excise Duties, Central Goods and Services Tax (CGST) and IGST and prevention of smuggling. In addition to this, the CBIC also looks over the administration of the matter related to Customs, Central Excise, CGST and Narcotics to the extent of the CBIC's extent.

[caption id="attachment_17214" align="alignnone" width="756"] CBEC Hierarchy. CBEC is a part of Ministry of Revenue[/caption]

CBEC Hierarchy. CBEC is a part of Ministry of Revenue[/caption]

These administrative duties of the CBIC also include looking over the subordinate organizations including Custom Houses, Central Excise and Central GST commiserates, as well, as the Central Revenues Control Laboratory.

Vision and Mission of CBEC (Now CBIC)

The Vision of CBIC (formerly CBEC)is to be a modern and professional indirect tax administration, aimed at safeguarding our economic frontiers adopting stakeholder-centric, an approach based on trust and voluntary compliance. Missions of the CBIC- Formulating progressive tax policies & processes to enable smooth economic activities.

- Realising revenue in a fair, equitable, transparent and efficient manner.

- Managing cross border movements of goods and people with a view to ensuring safety and security of citizens and economy of the country.

- Facilitating capacity enhancement of all stakeholders to improve compliance.

- Adopting international best practices and promoting bilateral and multilateral international cooperation.

- Investing in human capital to achieve a high level of integrity, competency, and commitment.

- Administering goods and services tax across India in harmony with state tax administrators.

- Innovative use of technology & techniques for maximum facilitation and minimal intervention.

- Combating tax evasion & commercial frauds with interventions based on risk assessment using analytics & predictive technology.

Functions of CBEC

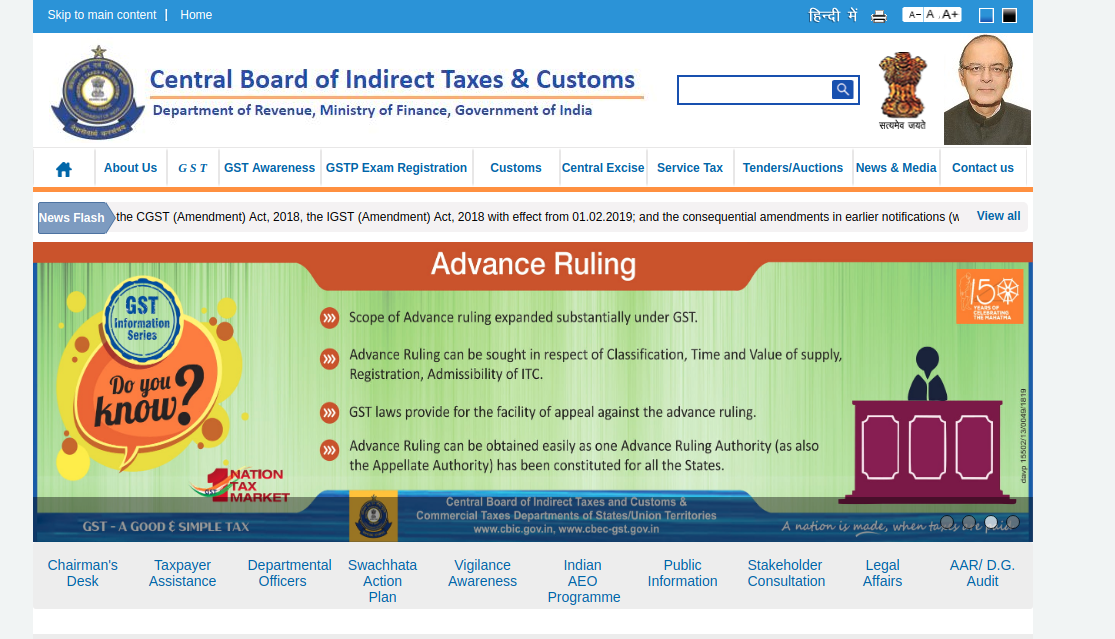

[caption id="attachment_17217" align="alignnone" width="1115"] CBEC Homepage[/caption]

As per the new website of CBIC, the functions of the CBEC are as follows:

CBEC Homepage[/caption]

As per the new website of CBIC, the functions of the CBEC are as follows:

Regulatory Functions

- Levy and collection of Customs and Central Excise duties, CGST & IGST

- Registration and monitoring of units manufacturing excisable goods and service providers

- Receipt and scrutiny of declarations and returns filed with the department

- Prevention of smuggling and combating evasion of duties and service tax

- Enforcement of border control on goods and conveyances

- Assessment, examination, and clearance of imported goods and export goods

- Implementation of export promotion measures

- Clearance of international passengers and their baggage

- Resolution of disputes through administrative and legal measures

- Sanction of refund, rebate, and drawback

- Realization of arrears of revenue

- Audit of assessments for ensuring tax compliance.

CBIC (formerly CBEC) is a portal and facilitation center which will help anyone with their queries with regards to revenue. Along with assisting every taxpayer in India, CBIC is proactive for the implementation as well as preparedness for the deployment of a new policy. CBCI is constantly on the up looking to make life simpler for the everyday taxpayer through new reforms, notifications, as well as, the press releases and other channels such as Twitter.

Tweets by cbic_indiaIt is interesting to note that the CBIC website in itself has no login or registration procedure for its website. The interaction via the website is only one-way. Although, the website does provide links to many login services for various other websites such as ICEGATE, ICETRAK, ACES, GST Registration etc.

[caption id="attachment_17227" align="aligncenter" width="443"] CBEC Important Links[/caption]

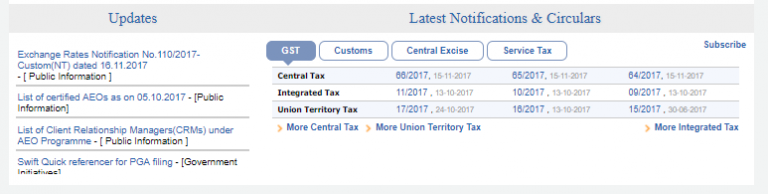

The CBIC website also displays the latest news with regards to the latest circulars and taxes like SGST, CGST, and, IGST.

[caption id="attachment_17228" align="alignnone" width="768"]

CBEC Important Links[/caption]

The CBIC website also displays the latest news with regards to the latest circulars and taxes like SGST, CGST, and, IGST.

[caption id="attachment_17228" align="alignnone" width="768"] CGST, SGST, IGST news on the CBIC app[/caption]

CGST, SGST, IGST news on the CBIC app[/caption]

CBEC and CBIC Services

The CBEC and CBIC websites combined together offer a lot of information and awareness of the GST regime. The old CBEC website also offers a provision of login via the GSTIN of the concerned taxpayer. With regards to this, these two websites together provide a variety of services which are listed as follows:Service Functions

- Dissemination of information on law and procedures through electronic and print media

- Enabling filing of declarations, returns, and claims through online services.

- Providing information on the status of processing of declarations, returns, and claims

- Assisting the right holders in protecting their intellectual property rights such as Trademark Filing, Patent, and Copyright

- Responding to public inquiries relating to Customs, Central Goods and Service Tax matters

- Providing Customs services such as examination of goods and factory stuffing of export goods at clients' sites, as per policy.

Additional Services

- GSTP Exam registration

- Tenders and Auctions

- Know Your Jurisdiction

- Media and Press Releases

- User Manual for Scheme for Budgetary Support (SBS)

- Informational FAQs on related topics such as E-Way Bill, as well as, TCS.

- Standard operating procedure for TDS