Advantages and Disadvantages of Letter of Credit

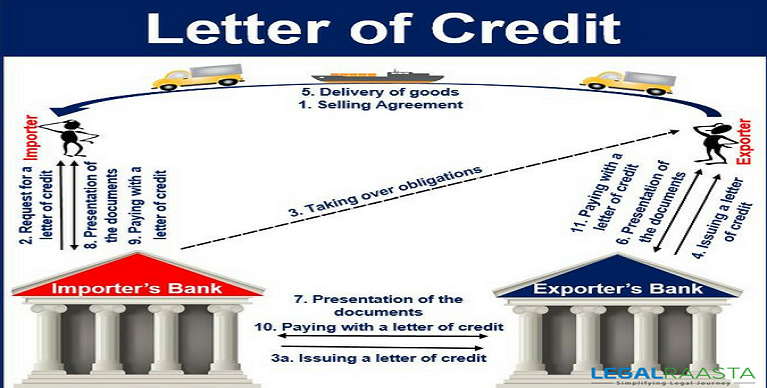

What is Letter of Credit?

A letter of credit is highly customizable and effective form which enables new trade relationships by reducing the credit risk, but it can add on to the cost of doing some uncertain business in the form of bank fees or formalities. It is basically a letter issued by one Bank to another as a guarantee of payment for a particular person on particular terms and conditionsAdvantages of Letters of Credit :-

Letter of Credit enjoys various numbers of advantages over other methods to do international trade transactions. Some of the major essential ones are listed as following:-- It gives the trading partners a chance to transact and interact with unknown people or establish new trade relationships.

- It helps in expanding and broadening their business quickly into new geographical areas.

- A letter of credit is highly effective and stable.

- Both the trading partners can put in terms and conditions as per their requirements and demands and then arrive at a mutually decided exclusive list of clauses.

- It makes the issuing bank independent of the trading partners’ obligations and any conflicts arising out of those liabilities.

- It transfers the credit-worthiness from the exporter or buyer to the issuing bank. The importer can do any number of transactions at the same time when he is backed by an established and larger institution.

- A letter of credit is safer for the exporter in case the importer goes bankrupt. Since the creditworthiness of the seller is transferred to the issuing bank, it is the bank’s obligation to pay the amount as agreed in the letter of credit. Therefore, a letter of credit implies the exporter from the importer’s business.

- A letter of credit is quick to administer. As per the initial terms and conditions, the seller has to show the proof of material type and quantity along with the documents enhancing his claim that the goods have been shipped. The advising bank will verify and judge the documents

- In the case of a conflict between the trading partners, the exporter can withdraw the fund and resolve the disputes later in the court.

- The seller cannot hold the payment to the buyer by raising objections on the quality of goods because the bank is just required to see the documents.

- The exporter can use pre-shipment financing against an LC. This will help him plugging the financing gaps if any.

- LC promotes instant liquidity.

- Credit of the Issuer is added in LC.

- LC is Independent of Issuer.

- Automatic Stay and Preferences system.

- Pay now, litigate later system.

- Adaptability is essential LC.

- Statute of Limitations is followed.

- Payment against right to receive goods another prominent advantage.

Disadvantages of Letters of Credit :-

As with any financial instrument, even this has disadvantages along with the advantage which is as following:-- It adds more cost on doing business as banks charge fee for providing services.

- A letter of credit follows complex governing rules and has chances that it can be misused to take advantage of the applicant.

- A letter of credit fears of a material fraud risk to the importer. The bank will pay the exporter upon looking at the shipping documents thoroughly and not the actual quality of goods displayed. Disputes and arguments can rise if the quality is different from what was agreed upon.

- A letter of credit also carries risk alongside.

- A letter of credit has an expiration date and must be used before it which is the greatest disadvantage as it becomes time restraint.

- A letter of credits carries payment risk with it though it can be circumvented if the bank promises the payment, which adds on to the cost of the LC.

- LCs are often treated by issuers like loans.

- Other forms such as a bond, insurance, documentary collection, open account sales, and guarantee are less costly forums.

- letters of credit for commercial things have complex rules.

- LCs often require the showcase of the original LC and all amendments.

- LCs must be changed each time there is an amendment in amount or terms or clauses.

- LC can be misused.

- LCs are often tough to terminate or cancel.