Concept of Accounting standards- A Study

Accounting standards refine, boost and enhance the exposure directness of financial reporting and its position.Meaning of Accounting Standards

Accounting Standards are inscribed as directorial principles. The documents furnished by expertise regulatory authority in accounting association or by the government administration shielding the exposure of.- Certification

- Dimension

- Ministration

- Demonstration

- A revelation of financial transactions

- Accounting and bookkeeping records and policies

Characteristics

On the basis of the meaning of accounting standard, we can state that the document is a director, authoritarian, solution provider, and coordinator in the arena of the accounting procedure.- As a director

- As an authoritarian

- A Solution Provider

- A coordinatorhttps://www.legalraasta.com/blog/depreciation/

Objectives

Accounting standards have the essence of coordinating, directing, authorizing. It is a solution provider which is generally evaluated as the language for enterprises and linked with the financial position of companies. The set of the guideline is achieved by forming the standards of rules and regulation. Let us explore the objectives required to regulate the financial statements and positions of companies.- Financial statements have to follow up in accordance with accounting standards for the user can dependence. So the prime focus is to refine the reliability of financial statements and in case the confirmation to the standards are not fulfilled, serious issues plus consequences a company can face.

- Ensuring the standards will permit for external and internal firm comparisons and that will upgrade and advance the firm financial position in the market. Comparing your company standard position with another is also the motive of accounting standards.

- Outlooking the comparison criteria the accounting standards deliver accounting policies that comprise of disclosure need and evaluation methods of variant financial statements and transactions.

Applications of accounting standards for companies

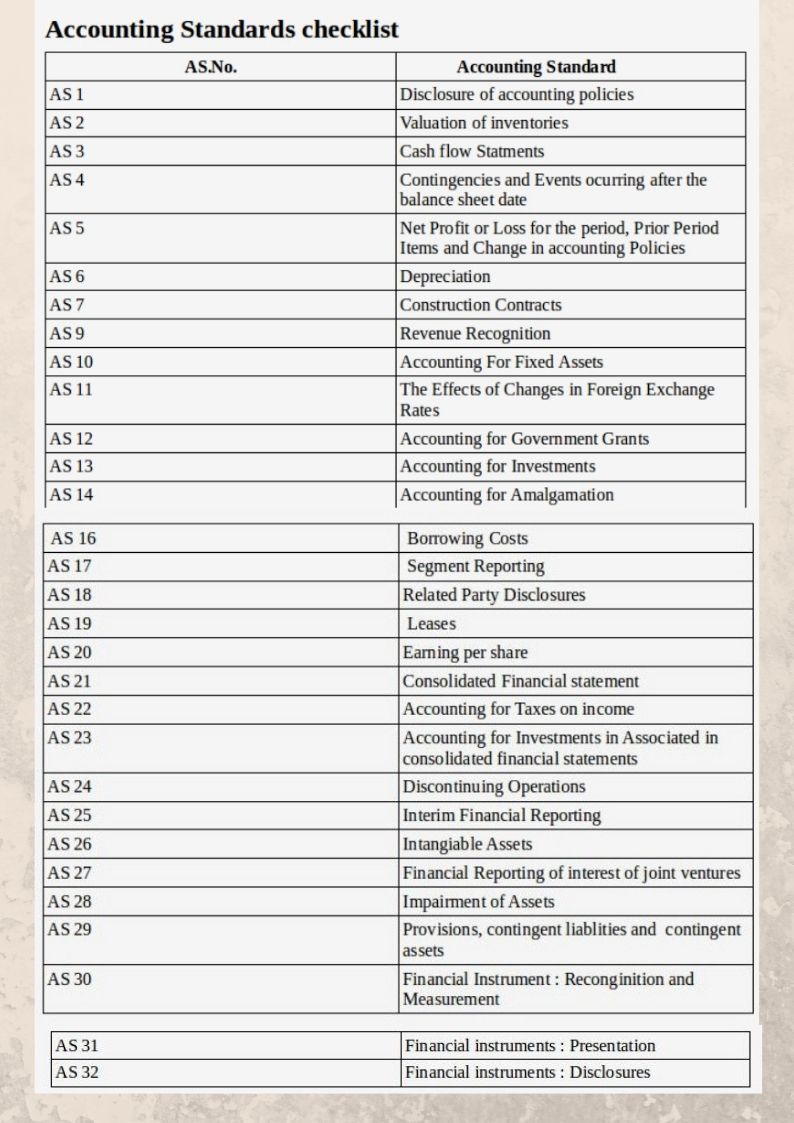

This application checklist is needed to be taken into account as they are mandatory to follow up by the companies for knowing its financial position. This a checklist for accounting standards is compulsory and one can go through all the AS No for and the accounting standards like cash flow statements, financial instruments, depreciation and many more gaining a high financial position in every financial year.

This a checklist for accounting standards is compulsory and one can go through all the AS No for and the accounting standards like cash flow statements, financial instruments, depreciation and many more gaining a high financial position in every financial year.

Merits

Accounting Standards are inscribed as directorial principles and the documents furnished by professional and expertise in accounting association or by the government administration or other regulatory authority shielding the exposure of certification, dimension, ministration, demonstration, and revelation of financial accounting transactions policies and practice. Forming upon the characteristics and objectives of accounting standards its clear vision that it does provide a sense of benefits in financial accounting transactions policies and practice to the enterprises and business. A glimpse of the merits in accounting standards.- The accounting standards render perfect accounting regulation, policies, and rules in a registered written format and all the policies need to be follow up. So if an auditor evaluates that the policies have been systematically followed he states that financial statements are fair and factual.

- The Accounting standard is body support for the financial position of a company and is compulsory to follow up. Further, these accounting fundamentals and techniques help in identifying the manipulative financial data by any entity or the companies. These standard sets eliminate the activity of frauds.

- In the arena of accounting standards, all the companies whether its national or international form up the same set of standard guidelines their financial accounts. But t_he financial positions are comparable. The financial statements can be inspected and compare the financial progress of numerous companies before coming to any decisions.

In the arena of accounting standards, all the companies whether its national or international form up the same set of standard guidelines their financial accounts. But the financial positions are comparable. The financial statements can be inspected and compare the financial progress of numerous companies before coming to any decisions.

Demerits

The accounting standards deliver refined accounting methods, regulation, policies, and which need to be follow up. In fact, there are little limitations of Accounting Standards updated by the regulatory bodies.- Accounting Standards cannot overrule the laws the standards have restricted scope. In addition, Financial Statements have to be shaped while keeping laws in mind which limits the best policies for the enterprises. Laws are mandatory to follow and no company would ever let it reputation down, so you have to follow them in any situation.

- The accounting standards will never provide guidelines to choose what is best for the companies and business. You need to allocate the best policies and choose the alternative policies which are a very complex decision for the company and its management.

Related Articles: Online Tax Accounting System Changes in Indian Accounting Standard for NBFCs