Pan Card Form: Form 49A & Form 49AA

What is PAN?

PAN is basically an electronic system with the help of which all the tax regarding information of a person or company is recorded against a single PAN Number. It is considered the most essential documents to be possessed by residents and citizens of India. PAN Card is the primary key for storage of information so as to identify the taxpayers. Therefore, no two tax paying entities can have the same PAN. Not only for taxpayers rather it is important for non-taxpaying residents to citizens to obtain a PAN Card because it would be required for various transactions. In this article, we will enlighten you about the kinds of PAN card form. Apply today for PAN Card registration with Legal Raasta and enjoy the perks. You can follow our blog for further details.PAN – Overview

| Authority's Name issuing PAN | Income Tax Department, Govt. of India |

| PAN Customer Care Number | 020 – 27218080 |

| The inception of PAN Card | 1972 |

| Validity Of PAN Card | Whole life |

| Cost of PAN Card | Rs. 499 |

| Number Of Enrolments | approx 25 crores |

Types of PAN Card Form

Mainly PAN card application forms are of two types which are given below: They serve both the purposes like they can either be used for online application or can be downloaded for offline application. Let us discuss these forms in a detailed manner.PAN Card Form 49A – Indian Citizens

Form 49A of a PAN Card is an application for allotment of Permanent Account Number under section 139A of the Income Tax Act, 1961. This form is meant for the entity incorporated in India, utilization of Indian citizens and unincorporated entities formed in India. The main purpose of applying for a new PAN Card as well as modifying any information submitted previously.PAN Card Form 49AA – Foreign Citizens

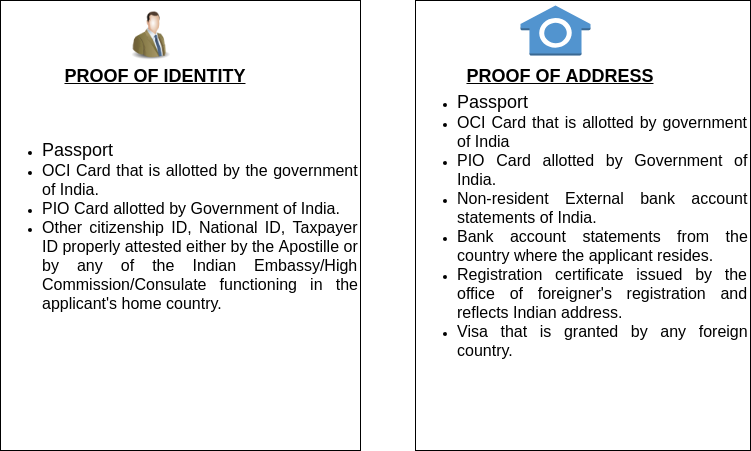

Form 49AA of a PAN Card is an application for allotment of Permanent Account Number that is governed by Rule 114 of the Income Tax Rules, 1962. It is meant for the entities incorporated outside India as well as unincorporated entities formed outside India and for utilization of Individuals who aren't citizens of India. PAN Card Form 49A is to be filled by specifying the same details as that of PAN Form 49A. Apart from it, the details pertaining to the KYC of the applicant needs to be filled by a Foreign Institutional Investor or a Qualified Foreign Investor as specified under the rules issued by the SEBI (Securities and Exchange Board of India). Further, it is must include the details that are mentioned below:Individuals

- Marital status

- Citizenship status

- Details of occupation

Non-Individuals

- Type of company

- Gross Annual Income in INR

- Net-worth in INR

- Details of the personnel involved

- Mode of Operation

- Whether the applicant or the applicant’s authorized signatories//office bearers/trustees are politically exposed or related to a politically exposed person

- Taxpayer Identification Number (TIN) in the residing nation

- Whether or not the company is listed in a recognized stock exchange

Documents required while applying for PAN Card by a Company

As companies do not have a huge list of address or identity proofs to choose from in order to apply for PAN, following are the requirements: Documents to apply PAN by a company registered in India- A Copy of registration certificate issued by the registrar of companies

- A copy of registration certificate issued by the Registrar of Firms or copy of Partnership Deed.

- A copy of a certificate of registration issued in India/ a copy of granted approval to set up a company in India by Indian Authorities.

Documents Required by a Firm to apply for PAN (includes Limited Liability Partnership) registered in India

Either of the following documents can be submitted:- A copy of a certificate of registration issued by the registrar of LLP (Limited liability partnerships)

- A copy of the partnership deed

Documents Required for PAN application by a Firm Registered outside India

- A Copy of Registration certificate issued by the Registrar of Firms/ a copy of Partnership Deed

- A Copy of certificate of registration issued in India/ a copy of approval granted to set up the firm in India by Indian authorities.

Documents required by a Limited Liability Partnership Registered outside India

- A Copy of Registration certificate issued by the Registrar of Firms or copy of Partnership Deed

- A Copy of certificate of registration issued in India or copy of approval granted to set up LLP in India by Indian authorities.

Documents required by Trusts Registered/Formed in India

- A copy of a deed of Trust.

- A copy of registration certificate Number issued by Charity Commissioner.

Documents Required by Trusts Registered outside India

- A Copy of registration certificate issued by the Registrar of Firms or copy of Partnership Deed

- A Copy of Certificate of registration issued in India or copy of approval granted to set up the trust in India by Indian authorities.

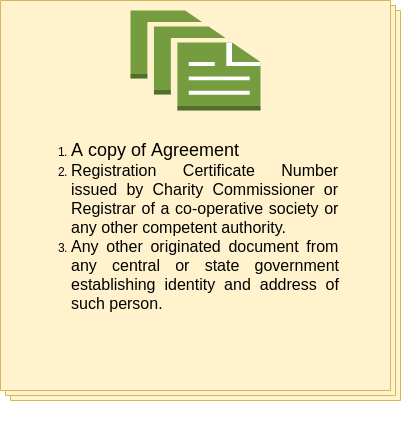

Documents Required by an Association of Persons (other than Trusts) Registered in India for PAN Application

Documents required by an Association of Persons (other than Trusts) Registered outside India

- A Copy of Registration certificate issued by the Registrar of Firms or copy of Partnership Deed

- A Copy of Certificate of Registration issued in India or copy of approval granted to set up the entity in India by Indian authorities.

Guidelines while completing the PAN Card Application

Following things must be kept in mind while filing the PAN Card form:- You must use block letters in the application form.

- The form will be filled in English language.

- The application shall be filled using blank ink.

- Fields that are marked as (*) are mandatory.

- The application should be devoid of any corrections or overwriting.

- You must use full names in the first as well as last name section instead of individuals.

- Make sure, that the names shouldn't contain any abbreviation, salutation or title.

- Left-hand thumb impression or signature must be provided across the photo on the left side of the form in such a manner that the portion of impression/signature is on the photo as well as the form.

- Most importantly thumb impression must be attested by a Magistrate/Gazetted officer/Notary Public.

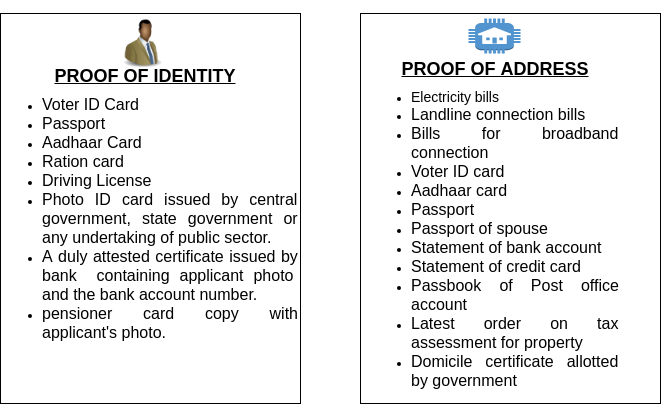

- The ID proof and address proof must be identical to the ones mentioned in the form.

- All kinds of documents must be enclosed as proof.

Related articles: Get Your PAN, TAN registration within 24hrs Apply for PAN Card in India Difference between TAN, PAN, DSC and DIN