Introduction

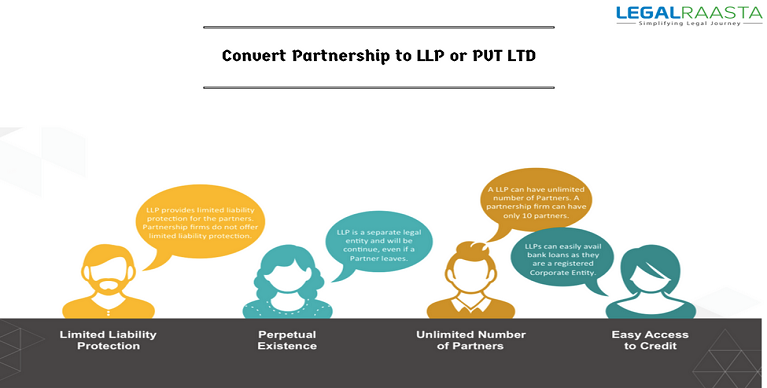

Partnership, Limited Liability Partnership, Private Limited Company, One Person Company, Sole Proprietorship, Public Company. A country like India gives you wide options when it comes to business. As an Entrepreneur, you have the choice to select between these forms of business. But before choosing you need to know the pros and cons of all these forms. You need to see which form will benefit you and your business the most. All of these forms have different requirements, different advantages, and disadvantages. Talking about Partnership, one of the biggest disadvantages of this form is the unlimited liability it provides to its partners. This feature puts the personal assets of the partners at high risk. To prevent this risk, there are firms and companies with limited liabilities. They are so named, Limited Liability Partnership and Private Limited Company. Entrepreneurs nowadays are going for conversion of their partnerships to these two forms of business to avoid the risk partnerships brings along. But how does this conversion takes place?

Conversion of Partnership into LLP

- The first thing you need to do while conversion of a partnership into an LLP is to get a DSC (Digital Signature Certificate). All the partners will require a digital signature.

- Then, obtain a DPIN (Designated Partner Identification Number). It is again mandatory for at least two partners in order to proceed with the conversion. It is a one-time number. There is no renewal or anything associated.

- Next, apply for name approval. It is one tricky part. The name should be selected carefully. Limited Liability Partnership will be used at the end of the company’s name.

- Finally, file LLP Form 17, LLP Form 2 and LLP form 3 for the conversion. Certain documents are required along with the form. Documents include:

- Address proof of registered office,

- Approval by regulatory authority,

- Details of partnership (including details of partners and directors)

- Consent of all the partners,

- Copy of the latest income tax return (can be acknowledgment),

- No Objection Certificate from tax authorities,

- List of creditors and their consent, and

- List of certified liabilities and assets.

- After the successful filing of all the documents along with prescribed fees, verification will take place. After which, a certificate will be issued to you. Hence, completing the conversion of your partnership into a Limited Liability Partnership successfully.

Conversion of Partnership into a Private Limited Company:

- When you want to convert your Partnership registration into a Pvt limited company you need to ensure that you have:

- A minimum of seven partners.

- A minimum share capital of Rupees one lakh.

- The authorized capital should be divided into units or shares.

- Object Clause of your Memorandum of Association (which will be drafted while conversion) should permit the company to be formed to acquire the assets and liabilities of the existing firm.

- Other than that, you will again require DSC (Digital Signature Certificate) for the directors as well as DIN (Director Identification Number).

- Memorandum of Association and Articles of Association has to be drafted. And the application for name approval is to be filed. The name will bear Private Limited Company at the end.

- Filing of form 18, 37, 32, 39, 40 and 41 along with identity proof, address proof of registered office and a No-objection certificate from the landlord.

- All these documents are filed along with prescribed fees, upon which a certificate is issued. Hence, completing the conversion successfully.

We, at LegalRaasta, can help you in the whole conversion process and make it much easier for you.